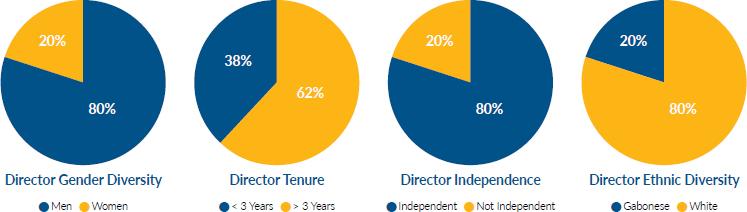

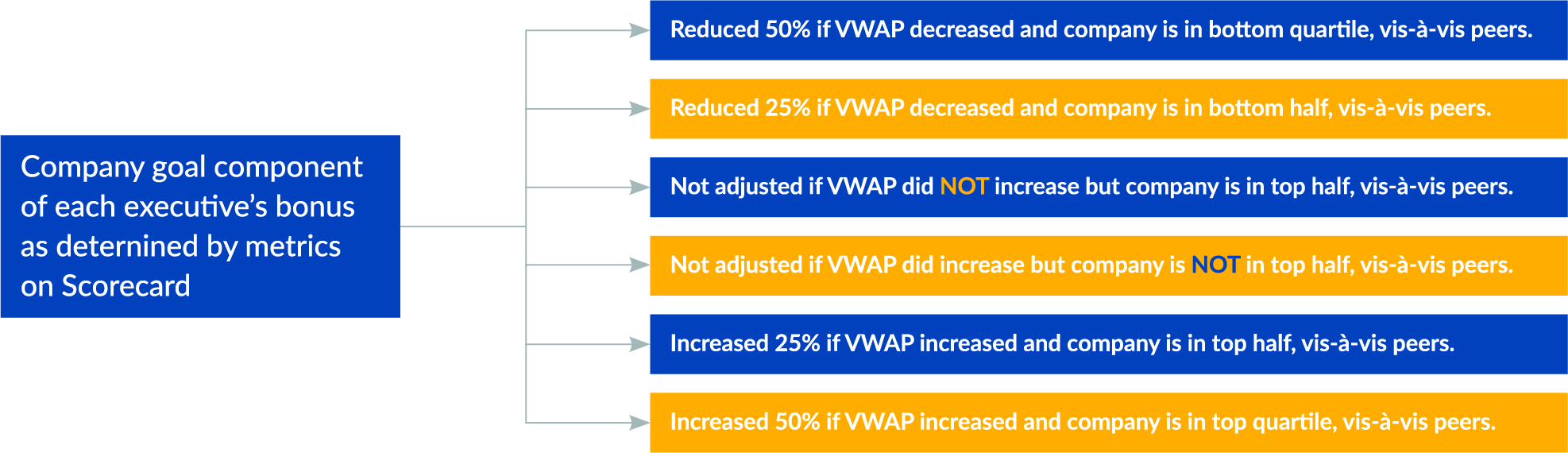

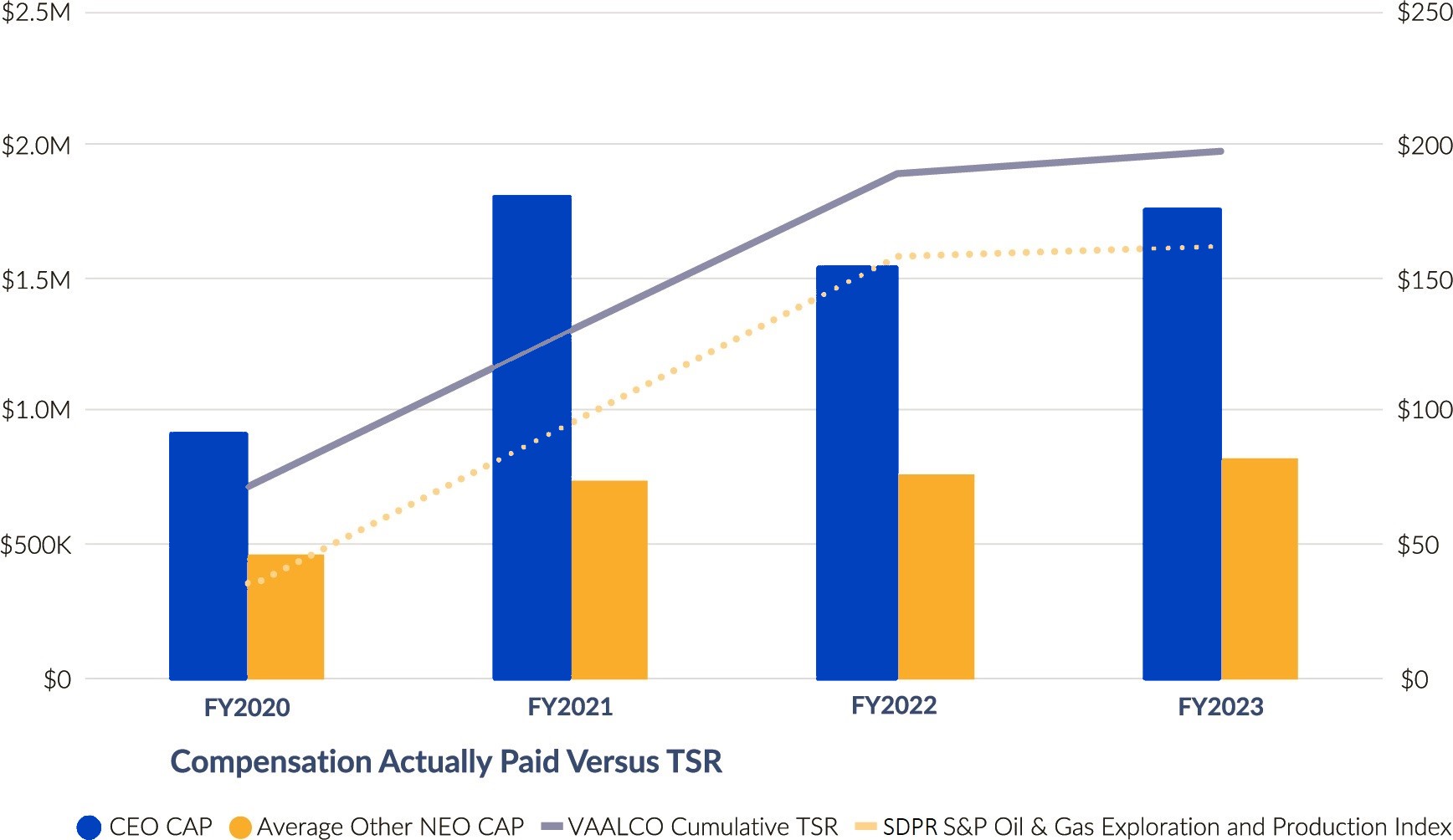

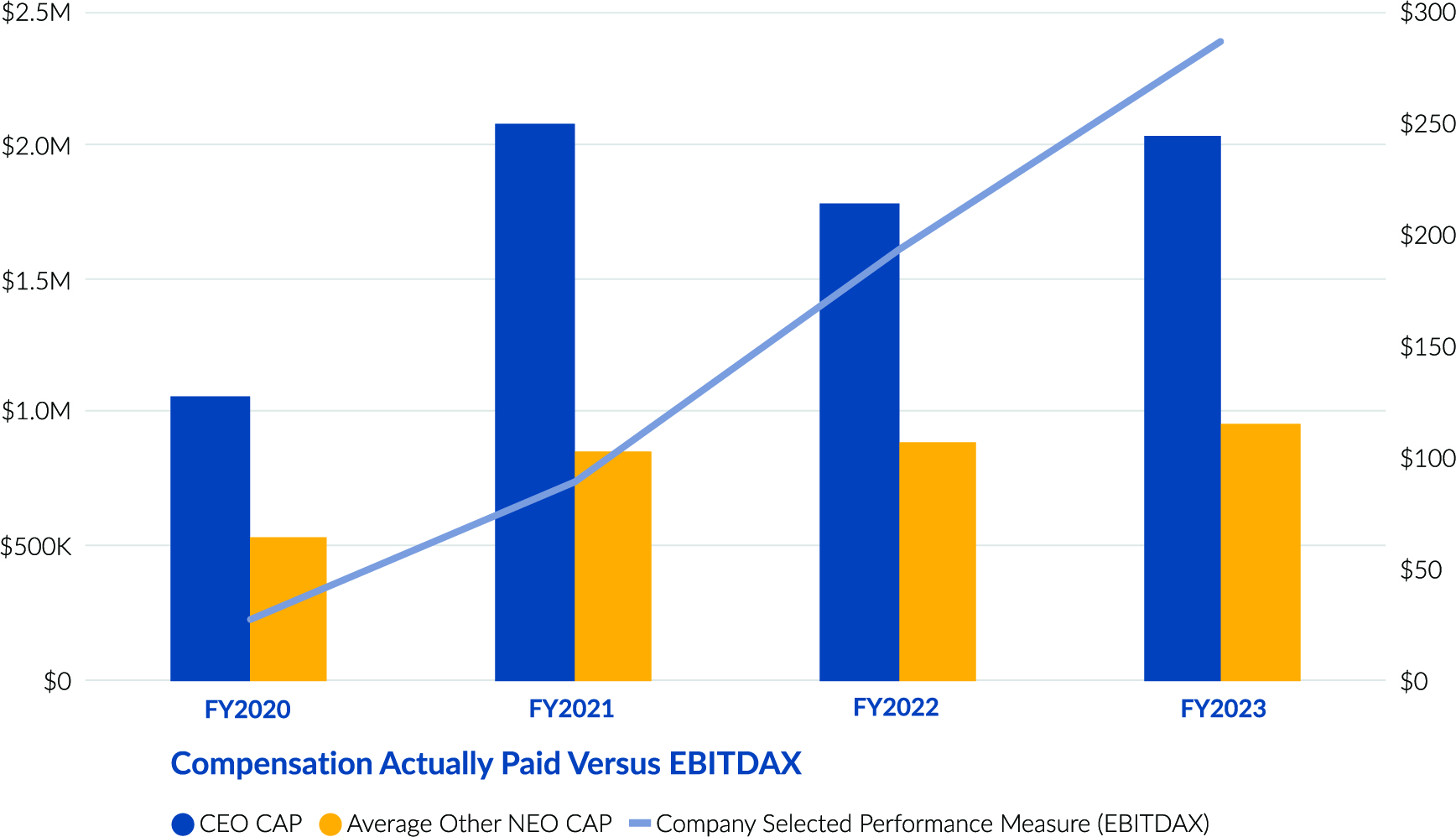

Registrant ☒ 2024 Proxy Statement A Letter from the Board of Directors Over the past two years, we have greatly diversified our portfolio, which has expanded our team's ability to generate operational cash flow, all while growing VAALCO's cash position and remaining bank-debt free. We are very pleased with our ability to deliver exceptional operational and financial results in 2023 that exceeded VAALCO's guidance and expectations following the TransGlobe combination that occurred in late 2022. The diversity of our asset base has allowed us to grow and generate significant operational cash flow to fund our activities. VAALCO's focus has been on optimizing production, managing our costs, and capturing operational and cost synergies, all while executing capital drilling campaigns to enhance profitability and growth. Through the execution of this strategy, we have significantly grown our cash position, fully funded our capital program, shareholder dividends and buybacks with internally generated funds, and remained bank debt free. In 2023, we returned over $50 million to shareholders through dividends and share buybacks. As we enter 2024, we have strong positive momentum as we continue to build size, scale and profitability to sustainably grow VAALCO. In February 2024, we announced a proposed all cash acquisition of Svenska Petroleum Exploration AB. The acquisition will utilize a portion of the $121 million in cash on the balance sheet at year-end 2023 to add production of 4,500 WI BOEPD and meaningful reserves. This acquisition would expand our diversified portfolio of assets to include offshore Cote d’Ivoire. We are adding an asset with strong current production and reserves at a very attractive price that is highly accretive on key metrics to our shareholder base and provides another strong asset to support future growth. It also enhances our diversification by strategically expanding our West African focus area and provides significant organic upside through additional drilling campaigns at Baobab and the future Kossipo development opportunity. At the Venus field in Block P offshore Equatorial Guinea, VAALCO finalized JOA documents in early 2024 and are proceeding with our Front-End Engineering Design (“FEED”) study. We anticipate the completion of the FEED study will lead to an economic Final Investment Decision (“FID”) which will enable the development of the Venus-Block P Plan of Development (“POD”). VAALCO has a proven operating track record for a development of this type and is well positioned, both operationally and financially, to execute this project and our other projects across an enhanced portfolio of opportunities. Our strategy remains unchanged: operate efficiently, invest prudently, maximize our asset base, and look for accretive opportunities. Our ability to execute this strategy has enabled us to deliver outstanding results over the past two years and has generated meaningful change at VAALCO while creating significant development opportunities well into the future. Our hard-working team is successfully executing plans that are focused on profitably growing production, reserves and value for our shareholders. We remain firmly focused on our strategic vision of accretive growth while maximizing shareholder return opportunities and operating with a strong focus on sustainability. On behalf of VAALCO’s executive management and employee team, we want to thank all of our shareholders for your continued support. Your vote is very important to us, and we encourage you to review the enclosed proxy statement and to promptly vote to ensure that your shares are represented at the Annual Meeting. Signed, The Board of Directors 3 VAALCO To the The Annual Meeting is being These proposals are described in the accompanying proxy materials. You will be able to vote at the Annual Meeting, or any adjournment, postponement or We are providing our shareholders access to our proxy materials over the Shareholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Shareholders who By Order of the Board of Directors, Andrew L. Fawthrop Chair of the Board Houston, Texas April 26, 2024 YOUR VOTE IS IMPORTANT! IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY The Proxy Statement and our Annual Report for If you have any questions or need assistance voting your shares, please call our proxy solicitor: D.F. King & Co., Inc. 48 Wall Street, 22nd Floor New York, NY 11005 Banks and Brokerage Firms, please call: (212) 269-5550 Shareholders, please call toll free: (866) 620-2535 4 2024 Proxy Statement Table of Contents Proxy Statement 2024 Annual Meeting YOUR VOTE IS IMPORTANT WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, WE ENCOURAGE YOU TO VOTE AND SUBMIT YOUR PROXY BY INTERNET, TELEPHONE OR MAIL. Governance Principles The Board’s Corporate Governance Principles, which include guidelines for determining director independence and 6 2024 Proxy Statement Proxy Statement Summary This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider in making voting decisions. You should read the entire Proxy Statement carefully before voting. Annual Meeting Information The Board is soliciting proxies for our 2024 Annual Meeting and any adjournment, postponement or recess thereof. Items of Business and Voting Recommendations Financial and Business Information We are a Houston, Texas-based, African-focused independent energy company with strong production and reserves across our portfolio of assets in Gabon, Egypt, Equatorial Guinea, and Canada. We engage in the acquisition, exploration, development and production of crude oil, natural gas and natural gas liquids (“NGL”). Throughout 2023, we continued to deliver operationally and generate significant cash flow. Our 2023 results firmly place VAALCO in a financially stronger position, poised to execute accretive growth initiatives in the future. Key highlights of our business and our performance in 2023 and the first part of 2024 include: 7 VAALCO Energy, Inc. 2023 Full Year Highlights: 2024 Accomplishments to Date: We focus on supporting sustainable shareholder returns and growth. We have no bank debt and remain firmly focused on our strategic vision of achieving significant shareholder returns by maximizing the value of, and free cash flow from, our existing resource base, coupled with highly accretive inorganic growth opportunities. Sustainability Highlights We put in place practices to support the rule of law, transparency and good governance, and to oppose corruption. We believe it is also important to contribute to society through business activities, social investment and philanthropic programs. Our core values are supporting and developing our employees and communities, promoting and practicing good environmental stewardship, and improving the quality of life of the people we interact with. Below are highlights of steps we have taken to help promote these values. Sustainability Oversight In October 2020, we mandated that our ESG Committee oversee policies and programs relating to social responsibility and environmental sustainability. In early 2022, we hired a full-time ESG Engineer to coordinate technical aspects of the Company’s ESG initiatives. In 2023, we hired a Director of ESG to manage our corporate ESG initiatives and align them with our strategic objectives. The Director of ESG reports directly to the Chief Operating Officer and works closely with the ESG Committee, the ESG Engineer, and other senior leaders across the organization. The Director of ESG is responsible for developing and implementing our ESG strategy, policies, and programs, and oversees the measurement and disclosure of our ESG performance and progress. By hiring a Director of ESG, we demonstrate our commitment to advancing our ESG agenda and creating long-term value for all of our stakeholders. 8 2024 Proxy Statement Since 2022, we have had a standing committee comprised of a cross section of employees, with full participation by our executive team, charged with monitoring adherence to our ESG standards and communicating findings to our ESG Committee. In April 2023 we released our 2022 ESG Report, which included key ESG sustainability metrics and a detailed analysis of our accomplishments and dedication to our people, the environment, and the countries where we operate. We prioritize ESG metrics in our executive compensation program to drive execution on these issues. The compensation plan’s ESG score considers total recordable incident rate, carbon footprint reduction targets and company-wide participation in ESG training. Human Capital Corporate Governance. We believe our director nominees exhibit a robust mix of skills, experience, diversity and perspectives. We value building diverse teams, embracing different perspectives, fostering an inclusive environment, and supporting diversity of thought, perspective, sexual orientation, gender, gender identity and expression, race, ethnicity, culture and professional experience. Our governance highlights include: 9 VAALCO Energy, Inc. Diversity of our Workforce. We have a long-standing commitment to equal employment opportunity and a robust and rigorously enforced Equal Employment Opportunity policy. We are proud to disclose that, as of December 31, 2023: Workforce Health and Safety We are fully committed to the health and safety of our employees and contractors. We maintain a goal of zero accidents, injuries, unsafe work practices or unsafe conditions for our employees. We prioritize and assure adequate employee training on health and safety issues. We have designed health and safety training programs to reduce risk across our operations, communicated high and insistent expectations of our partners, and created systems that support conformance to these standards. Environmental Stewardship We are committed to responsible environmental stewardship. We take precautions to protect natural resources and to prevent accidents from occurring. We have consistently operated our facilities within the International Convention for the Prevention of Pollution from Ships (“MARPOL”) water discharge standard. In 2023, we had no regulatory reportable spills or loss of containment that impacted the environment. Health, Safety and Environmental Management In 2023, recognizing the paramount importance of Health, Safety, Security, and Environment (“HSSE”) standards across our corporate portfolio of assets, we introduced the role of HSSE Director. This strategic addition fortifies our commitment to maintain consistency and alignment with globally recognized norms and standards. The HSSE Director oversees the spectrum of HSSE concerns within our organizational framework. This includes proactively identifying potential risks, instituting robust protocols for mitigation, and ensuring that all operational endeavors adhere rigorously to international benchmarks. The HSSE Director spearheads initiatives aimed at fostering a culture of safety consciousness and environmental stewardship. By cultivating an environment where adherence to HSSE principles becomes ingrained in our corporate ethos, the HSSE Director plays an instrumental role in safeguarding not only our assets but also our reputation and societal trust, and serves as the linchpin for integrating best practices and cutting-edge methodologies into our operational framework. By remaining abreast of evolving global standards and emerging trends, the HSSE Director ensures that our organization remains poised to adapt and excel in an ever-evolving landscape. We believe the appointment of the HSSE Director demonstrates our commitment to prioritizing safety, security, and environmental sustainability across all facets of our operations. Through his leadership and strategic vision, we continue to fortify our position as a responsible corporate citizen, dedicated to upholding our commitment to HSSE excellence on both a local and international scale. 10 2024 Proxy Statement Health, Safety and Environmental Management Systems. Our Internal Resources for Administering Safety (“IRAS”) system was developed to effectively communicate across the various levels and functions within VAALCO safety and environmental objectives, goals and performance measures set by management. Our IRAS system is designed to align with International Organization for Standardization (“ISO”) 45001. Our program incorporates numerous elements in order to achieve the highest level of risk mitigation possible. These elements include: Greenhouse Gas Emissions. We are committed to managing our emissions and seek to identify, evaluate and measure climate-related risks by incorporating them in our management process and field development plans. During 2023, we continued to build upon our work from the previous year and have identified several areas in which we were able to achieve significant impacts on overall emissions: Water Management. In Gabon, where we operate offshore, all produced water is treated to meet or exceed MARPOL standards. We reinject all water used in our Canadian and Egyptian operations, thereby minimizing impacts on surrounding ecosystems. 11 VAALCO Energy, Inc. Community Involvement We take pride in our reputation as a good corporate citizen, and we continue to support the communities where we operate. We view our support and involvement in local communities as being critical to our “social license to operate.” 12 2024 Proxy Statement Proposal No. 1 Election of Directors Director Nominees On March 8, 2024, the Board, upon recommendation of the ESG Committee, voted to nominate the individuals named in the table below for election. The Board asks you to elect the five nominees named below as directors for a term that expires at the 2025 annual meeting of shareholders. The table below provides summary information about the five director nominees. For more information about the director nominees, see page 19. Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm Auditor Ratification The Board is asking you to ratify the selection of KPMG LLP (“KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2024. Even if our shareholders ratify the appointment of KPMG, the Audit Committee may, in its sole discretion, terminate such engagement and direct the appointment of another independent registered public accounting firm at any time during the year. For additional information concerning KPMG, see page 36. 13 VAALCO Energy, Inc. Proposal No. 3 Advisory Resolution on Executive Compensation Say-on-Pay Pursuant to Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we are asking our shareholders to approve, on an advisory or non-binding basis, the compensation of our named executive officers (“NEOs”) as disclosed in this Proxy Statement. For a detailed description of our executive compensation program, see “Compensation Discussion and Analysis” beginning on page 44. Proposal No. 4 Approval of an Amendment to the VAALCO Energy, Inc. 2020 Long Term Incentive Plan to Increase the Number of Shares Reserved for Issuance Pursuant to Awards Amendment to VAALCO Energy, Inc. 2020 Long Term Incentive Plan The Board is asking you to approve an amendment to the VAALCO Energy, Inc. 2020 Long Term Incentive Plan (the “2020 LTIP”) to increase the number of shares reserved for issuance pursuant to awards under the 2020 LTIP (the “LTIP Amendment”). The Board adopted the LTIP Amendment upon the recommendation of the Compensation Committee, subject to shareholder approval. Our Board and our Compensation Committee approved the LTIP Amendment because they believe that the number of shares of common stock currently available under the 2020 LTIP is insufficient to meet our future equity compensation needs. Shareholder approval of the LTIP Amendment is intended to ensure that the Company has sufficient shares available to attract and retain key employees, key contractors and outside directors, and to further align the interests of our employees and directors with the Company’s shareholders by making a significant portion of their compensation directly tied to the performance of the Company’s share price. The Board and Compensation Committee believe that the requested increase will allow for enough shares to cover the next three annual award grants. For more information on the LTIP Amendment, see page 81. 14 2024 Proxy Statement Vote Required for Each Proposal Voting and Other Procedures Related to the Annual Meeting Record Date and Persons Entitled to Vote The Board Procedure to Access Proxy Materials Over the Internet Your Notice or (if you received paper copies of the proxy materials) your proxy card will contain instructions on how to view our proxy materials for the Annual Meeting on the How to Vote The Board encourages you to exercise your right to vote. Telephone and Voting by proxy will not limit your right to vote at the Annual Meeting if you decide to attend in person. The Board recommends that you vote by proxy since it is not practical for most If you are a street name The shares represented by all valid proxies received by telephone, by How to Change Your If you are a If you are a street name 16 2024 Proxy Statement Quorum Your stock is counted as present at the Annual Meeting if you attend the Annual Meeting and vote in person or if you properly vote by Routine and Non-Routine Matters; Abstentions and Broker The New York Stock Exchange (“NYSE”) permits brokers to vote their customers’ stock held in street name on “routine matters” when the brokers have not received voting instructions from their customers. The NYSE does not, however, allow brokers to vote their customers’ stock held in street name on non-routine matters unless they have received voting instructions from their customers. In such cases, the uninstructed shares The ratification of the appointment of the independent The election of directors, Proxy Solicitation In addition to sending you these materials or otherwise providing you access to these materials, some of our directors and officers as well as management and non-management employees may contact you by telephone, mail, e-mail or in person. You may also be solicited by our proxy solicitor, D.F. King & Co., by means of press releases issued by VAALCO, postings on our website at www.VAALCO.com, advertisements in periodicals, or other media forms. None of our officers or employees will receive any extra compensation for soliciting you. We will Tabulation Results of the Vote We will announce the preliminary voting results at the Annual Meeting and disclose the final voting results in a current report on Form 8-K filed with the List of A complete list of all 17 VAALCO Energy, Inc. Proposal No. 1 Election of Directors Overview On March 8, 2024, the Each nominee currently The Board Director Nominee Information and Qualifications The following table provides information with respect to each nominee. Each director will be elected to serve until the next annual meeting or his or her earlier death or resignation or until his or her successor is elected and qualified. 18 2024 Proxy Statement The following is a brief description of the background and principal occupation of each director nominee: Andrew L. Fawthrop Director and Chairman of the Board Age: 71 Director Since:2014 Andrew L. Fawthrop —Mr. Fawthrop has served on the Board since October 2014 and as the Chairman of the Board since December 2015. Mr. Fawthrop has deep and broad-based experience in the oil and gas industry, including in Africa, having served for 37 years with Unocal Corporation and Chevron Corporation (following its acquisition of Unocal in 2005) in a vast number of international leadership positions. Most recently, from January 2009 until his retirement in 2014, Mr. Fawthrop served as Chair and Managing Director for Chevron Nigeria. Prior to his assignment in Nigeria, Mr. Fawthrop served as President and Managing Director for Unocal/Chevron Bangladesh from 2003 until 2007. In his professional career, Mr. Fawthrop held various positions of increasing responsibility for exploration activities around the world in geographies including China, Egypt, Indonesia, South America, Africa, Latin America and Europe. Mr. Fawthrop served as a Member of the Advisory Board of Eurasia Group. He served as a Director of Hindustan Oil Exploration Co. Ltd. from 2003 to 2005. He was an active member of the United States Azerbaijan Chamber of Commerce, the Asia Society of Texas and the Houston World Affairs Council. Mr. Fawthrop holds a Bachelor of Science in Geology and Chemistry and a Master’s degree in Marine Geology from the University of London. Mr. Fawthrop’s significant experience in the international exploration and production (“E&P”) industry, particularly his experience in Africa, provides a valuable resource to the Board. In addition, through his prior leadership roles and activities, he has extensive operational experience and strategy-making abilities with an executive-level perspective and knowledge base that provides a strong platform for the Board. George W. M. Maxwell Director and Chief Executive Officer Age: 58 Director Since:2020 George W. M. Maxwell —Mr. Maxwell became Chief Executive Officer of VAALCO in April 2021. Mr. Maxwell has over 25 years of experience in the oil and gas industry, including in both the producing and service/manufacturing arenas. Mr. Maxwell founded Eland Oil & Gas Plc. in 2009 and served as the company’s Chief Executive Officer from September 2014 to December 2019, Chief Financial Officer from 2010 to 2014, and as a member of the board of directors from 2009 to 2019, until the company was acquired by Seplat Petroleum Development Company Pls. on December 17, 2019. Prior to founding Eland Oil & Gas Plc., Mr. Maxwell served as the business development manager for Addax Petroleum and, prior to this, commercial manager in Geneva. Mr. Maxwell joined Addax Petroleum in 2004 and held the general manager position in Nigeria, where he was responsible for finance, and fiscal and commercial activities. Prior to this, Mr. Maxwell worked with ABB Oil & Gas as vice president of finance based in the UK with responsibilities for Europe and Africa. He held a similar position in Houston, from where the organization ran its operations in ten countries. Mr. Maxwell was finance director in Singapore for Asia Pacific and Middle East, handling currency swaps and minimizing exposures during the Asian financial crisis of the late 1990s. Mr. Maxwell graduated from Robert Gordon University in Aberdeen with a Master’s in Business Administration. Mr. Maxwell is a Fellow of the Energy Institute in the UK and has formerly served on the boards of directors of Elcrest Exploration and Production Nigeria Ltd. and Westport Oil Limited. Mr. Maxwell’s significant experience serving in executive leadership positions and on the boards of E&P companies, as well as his experience in mergers and acquisitions and strong ties to the London investment community, provide invaluable insight, making him an important resource for the Board. 19 VAALCO Energy, Inc. Cathy Stubbs Director Age: 57 Director Since:2020 Cathy Stubbs —Ms. Stubbs has served on the Board since June 2020. Ms. Stubbs has over 30 years of experience in the energy industry, most recently serving 17 years with Aspire Holdings, LLC (formerly Endeavour International Corporation), an independent international oil and gas exploration and production company focused in the North Sea and United States. Ms. Stubbs held numerous roles with Aspire Holdings, LLC, including as a director and President and Chief Financial Officer from 2015 to 2021, Senior Vice President and Chief Financial Officer from 2013 to 2015, Vice President, Finance and Treasury, and served in other corporate development and accounting roles from 2004 to 2013. Prior to joining Aspire Holdings, LLC she served as Assistant Controller, Financial Reporting and Corporate Accounting at Devon Energy, Inc. (formerly Ocean Energy, Inc.) from 1997 to 2004. Ms. Stubbs began her career in public accounting with KPMG, an international audit and business strategy consulting firm, where she rose to the title of Audit Manager. Ms. Stubbs is a Certified Public Accountant in the State of Texas and she currently serves on the board of directors of Amazing Place, and serves as the treasurer and supervisor of Memorial Villages Water Authority Board. Ms. Stubbs holds a Bachelor’s degree in Business Administration, and Master’s degree in Professional Accounting, from the University of Texas at Austin. Ms. Stubbs’ significant experience in accounting, finance, risk management and her service in various director and executive roles provide a valuable resource to the Board. Fabrice Nze-Bekale Director Age: 50 Director Since:2022 Fabrice Nze-Bekale —Mr. Nze-Bekale joined the Board in 2022. He has over 25 years of experience in mining, banking, telecoms, mergers and acquisitions and international finance. Mr. Nze-Bekale has served on numerous boards and as a senior executive across his career. He currently serves as an independent director on the Board of Orabank Gabon, where he is also the Chairman of the Audit Committee and serves on the Risk Committee and Ethics and Good Governance Committee. Mr. Nze-Bekale is the Chairman of the board of directors of Airtel Money Gabon, a role he began in 2021. He was appointed to the board of directors of Gabon Power Company, the Gabonese sovereign wealth fund’s vehicle dedicated to developing PPPs in the utilities sector, in January 2024. He also began serving as the executive president of the board of directors of Gabon Angel Investing Network in 2021. From 2012 to 2020, he was a member of the Board of the Fonds Gabonais d’Investissements Strategiques, Gabon’s sovereign wealth fund. He has also served on the Boards of several Gabonese mining companies. Mr. Nze-Bekale has been Chief Executive Officer of ACT Afrique, a leading advisory firm in West Africa and based in Dakar, Senegal, since 2017, and an executive member of the board of directors since 2020. ACT Afrique provides strategic advisory and investment banking expertise to governments as well as to public and private entities in West Africa. Prior to joining ACT Afrique, from 2012 to 2017, he served as Chief Executive Officer of Societe Equatoriale des Mines, the national mining company in Gabon, which he helped create to manage Gabon’s investments in the sector. Prior to that, he was Director of Investment Banking for Standard Bank PLC based in London from 2008 to 2011 and Finance Manager for Celtel International from 2005 to 2008. Fabrice began his career at Citibank Gabon, where he rose to become the Head of Corporate Banking. Mr. Nze-Bekale is a Gabonese national and holds a Master’s degree in Finance and Financial Engineering from the University of Paris-Dauphine (France) with a Master of Business Administration from the London Business School (UK). Mr. Nze-Bekale’s significant experience in the areas of mining, banking, telecom and finance, his service in various director and executive roles, and his knowledge of Gabon and other West African countries make him a valuable resource for the Board. 20 2024 Proxy Statement Edward LaFehr Director Age: 64 Director Since:2022 Edward LaFehr —Mr. LaFehr joined the Board following VAALCO’s combination with TransGlobe in October 2022. Mr. LaFehr was appointed to TransGlobe’s Board of Directors in March 2019. Mr. LaFehr retired from Baytex Energy Corporation in January of 2023 after serving 6 years as President and Chief Executive Officer. Since November of 2023, Mr. LaFehr has served on the Board of Directors of STEP Energy Services Ltd. (TSE:STEP), an energy services company that provides coiled tubing, fluid and nitrogen pumping and hydraulic fracturing solutions. Mr. LaFehr has 40 years of experience in the energy industry working with Amoco, BP, Talisman, TAQA and Baytex, holding senior positions in North American, European and Middle Eastern regions. Prior to joining Baytex, he was President of TAQA’s North American energy business and subsequently Chief Operating Officer for TAQA, globally. Prior to this, he served as Senior Vice President for Talisman Energy. From 2009 to 2011 Mr. LaFehr was Managing Director of Pharaonic Petroleum Company in Cairo, Egypt. He also served on BP Egypt’s executive team and represented BP’s interests on the Board of the Pharaonic JV as well as ENI’s Petrobel JV with the Egyptian Government. Mr. LaFehr holds Master’s degrees in geophysics and mineral economics from Stanford University and the Colorado School of Mines, respectively. Mr. LaFehr’s significant experience in executive roles at energy companies, as well as his expertise and credentials pertaining to oil, natural gas and NGL exploration, development and production, make him a valuable addition to the Board. Vote Required The director nominees will be elected by a plurality of the votes cast. For this proposal, abstentions and broker non-votes will not be taken into account for purposes of determining the outcome of the election of directors. If you own your shares through a broker, you must give the broker instructions to vote your shares in the election of directors. Otherwise, your shares will not be voted. However, if you submit a proxy card, any proposals for which you do not provide instructions will be voted in accordance with the Board’s recommendations. Board Recommendation The Board recommends that shareholders vote “FOR” the election of each of the nominees. 21 VAALCO Energy, Inc. Board Composition, Independence and Communications Board Composition The following table provides information about each director currently serving on our Board: ● Member ● Chair The directors’ experiences, qualifications and skills that the Board considered in their re-nomination are included in their individual biographies set forth above under “Proposal No. 1—Election of Directors.” Director Independence It is VAALCO’s policy that a majority of the members of the Board be independent. Our common stock is listed on the NYSE and the London Stock Exchange (the “LSE”) under the symbol “EGY.” The rules of the NYSE require that a majority of the members of our Board be independent and the LSE recommends that at least a majority of the members of the Board be independent. In assessing independence, the Board has determined that, with respect to each of Messrs. Fawthrop, LaFehr and Nze-Bekale, and Ms. Stubbs, no material relationship exists that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out their responsibilities as directors. In addition, the Board considered relationships and transactions involving directors or their affiliates or immediate family members that would be required to be disclosed as related party transactions and described under “—Related Party Transactions” below, of which there were none; and other relationships and transactions involving directors or their affiliates or immediate family members that would rise to the level of requiring such disclosure, of which there were none. Based on the foregoing, the Board affirmatively determined that each of Messrs. Fawthrop, LaFehr and Nze-Bekale and Ms. Stubbs qualifies as “independent” for purposes of the Company’s Corporate Governance Principles and NYSE listing rules. Mr. Maxwell does not qualify as “independent” because he is an employee of the Company. The Board has also determined that each member of the Audit Committee qualifies as independent under the audit committee independence rules established by the SEC, and meets the NYSE’s financial literacy requirements. In addition, each member of the Compensation Committee qualifies as a “non-employee director” under SEC rules. There are no family relationships between any of our directors or executive officers. 22 2024 Proxy Statement Selection of Director Nominees General Criteria and Process.We The ESG Committee identifies nominees by first evaluating the current members of the Board willing to continue their service. Current members with qualifications and skills that are consistent with the As to new candidates, the ESG Committee will generally poll the Board 23 VAALCO Energy, Inc. Shareholder Recommendation of In order to provide our shareholders and All communications received in accordance with A director who receives any such communication will have discretion to determine whether the The Corporate Secretary will retain copies of all communications received pursuant to these procedures for a one year. The Board will review the effectiveness of 24 2024 Proxy Statement Corporate Governance Board Risk Oversight While the Succession Planning A key responsibility of our CEO and Board is ensuring that an effective process is in place to provide continuity of Board Leadership Structure Our current board structure separates the roles of Chief Executive Officer and Our Board Evaluation We believe a rigorous Board evaluation process is important to ensure the ongoing effectiveness of our Board. To that end, our ESG Committee Insider Trading Policy; Prohibition on Hedges and Pledges We have an insider trading policy that prohibits our officers, directors and employees from purchasing or selling our securities in the open market while being aware of material, non-public information about the Company and disclosing such information to others who may trade in securities of the Company. 25 VAALCO Energy, Inc. Our insider trading policy also prohibits our officers, directors and employees from engaging in hedging activities or other short-term or speculative transactions in the Company’s securities such as zero-cost collars and forward sale contracts. We believe that these hedging transactions would allow the persons covered by our insider trading policy to own our securities without the full risks and rewards of ownership, which could result in misalignment between our general shareholders and the individual Stock Ownership The Board Each officer or non-employee director has five years from the adoption of the policy or date of appointment, whichever is later, to attain compliance with the ownership requirement and, until a covered individual is in compliance, that individual must retain an amount equal to 60% of the net shares received since appointment as a result of the exercise, vesting or payment of any Company equity awards granted. If, for any reason, an individual’s ownership falls below Compliance with this policy Code of Ethics and Corporate Governance Documents We have adopted a Code of Business Conduct and Ethics for Directors, Officers and Employees and a Code of Ethics for the Chief Executive Officer and Senior Financial Officers. Both codes are available on our website at www.VAALCO.com. Our website also includes copies of the other corporate governance policies we have adopted, including our Corporate Governance Principles, as well as the charters of our Audit, Compensation and ESG Committees. Print copies of these documents are available upon request by contacting our investor relations group. We have not granted any waivers to our codes of ethics to any of our directors or executive officers. To 26 2024 Proxy Statement Environmental, Social and Corporate Governance We believe that in addition to being the right thing, operating our business ethically and responsibly is the foundation of our long-term success. Social and environmental values guide how we manage our business, and allow us to help local economies thrive. In addition to the ESG matters highlighted above, we are focused on three principle values: (i) a commitment to the safety of our employees and the environment, (ii) a commitment to society and local communities, and (iii) a commitment to high ethical standards. Our Board’s experience in the oil and gas sector and Africa provides a strong foundation to oversee ESG issues facing VAALCO and our industry. Commitment to World-Class Safety.We have the highest regard for the health and safety of our employees, our contractors and the communities where we operate. Our commitment to safe operations is foundational to our business strategy, and reflects our unwavering commitment to the highest HSE standards as an operator. In light of this commitment, we have undertaken efforts to align our safety management systems with international standards, such as ISO 45001, which is the International Organization for Standardization’s standard for management systems of occupational health, and safety published in March 2018. In addition, we regularly engage in process safety management training and have developed our own “people-based” safety program. We foster environmental stewardship through continuous training programs, dedicated emergency environmental response capabilities and being wholly conscious of any environmental impact of our operations, including impacts on carbon emissions and biodiversity. During 2020, we undertook a comprehensive baseline study to more fully understand and manage our carbon footprint. In 2023, we recalibrated and expanded the model to capture our newly acquired assets in Canada and Egypt. This baseline allows us to make better and more informed decisions that will shape our carbon reduction strategy and refine targets. The baseline study comprised building a greenhouse gas emissions inventory and diagnostic across the entire operating base and asset integrity audits. Our commitment to safety is also directly reflected in our compensation philosophy. Our Compensation Committee considers safety performance as an annual factor in determining the annual bonus payable to our NEOs. We believe that linking executive officer remuneration to safety performance helps directly incentivize our executives to instill a safety-first culture. We regularly support, promote and participate in a number of community initiatives in the Houston area and in the countries where we operate that involve a mix of charitable contributions, training and workforce participation. These initiatives include: We continue to support the Krause Children’s Center that serves young women between the ages of 12 to 17 on their road to recovery from difficult domestic situations. Our Houston employees also volunteer with Junior Achievement programs that help students realize the value of education. 27 VAALCO Energy, Inc. Commitment to Ethics.We hold our business and employees to the highest ethical standards. Our corporate governance policies are designed to conform to both SEC guidelines and the U.K. Corporate Governance Code and are overseen by our majority independent Board. We do not tolerate bribery or corruption and we rigorously educate our employees on compliance with applicable anticorruption laws. We believe a commitment to high ethical standards benefits all of our stakeholders, including investors, employees, customers, suppliers, governments, communities, business partners and others who have a stake in how we operate. Governing our operations.VAALCO remains committed to cultivating a culture anchored in ethical principles, adherence to the legal requirements in the regions where we operate, and on personal accountability and ethical conduct in engagements with governments, contractors, business partners, and among ourselves. Our corporate policies set our standards for ethical conduct and are applicable to all personnel. ESG Report.It is right, and it is necessary for our long-term success, to operate our business ethically and responsibly. This includes operating in a manner that takes into account our environmental impact. We encourage you to review the “Sustainability” section of our website, www.VAALCO.com, for details. You can also view our 2022 ESG Report there.[1] Compensation Committee Interlocks and Insider Participation The current members of the Compensation Committee are Andrew L. Fawthrop, Edward LaFehr, Fabrice Nze-Bekale, and Cathy Stubbs. None of our executive officers serves as a member of the compensation committee of any other company that has 28 2024 Proxy Statement Board Committee Membership and Meetings Committees of Directors Our Board has three standing, regular committees: the Audit Committee, the Compensation Committee and the ESG Committee. Each has a charter that governs the duties and responsibilities of the committee, which is available on VAALCO’s website at www.VAALCO.com. Each committee is operated according to the rules of the NYSE and each committee member meets the applicable independence requirements of the NYSE and SEC. Our Board has also determined that each member of the Compensation Committee constitutes a “non-employee director” for purposes of Rule 16b-3 promulgated under the Each of our Board committees reports to the Board. The composition, duties and responsibilities of our Board committees are described below. The Board has determined that each Audit Committee member is financially literate within the meaning of NYSE listing standards. In addition, the Board has determined that Ms. Stubbs qualifies as an “audit committee financial expert” in accordance with SEC rules and the professional experience requirements of the NYSE. Designation as an “audit committee financial expert” does not impose upon the designee any duties, obligations, or liabilities that are greater than those imposed on other members of the Audit Committee and the Board, and such designation does not affect the duties, obligations, or liability of any other member of the Audit Committee or the Board. Under the terms of its charter, the Audit Committee is authorized to engage independent advisors at the Company’s expense for advice on any matters within the scope of the Audit Committee’s duties. The Audit Committee may also form subcommittees and delegate its authority to those subcommittees as it deems appropriate. 29 VAALCO Energy, Inc. Reviews and approves salaries and other compensation for executive officers other than the Chief Executive Officer Under the terms of its charter, the Compensation Committee is authorized to engage independent advisors at the Company’s expense for advice on any matters within the scope of the Compensation Committee’s duties. The Compensation Committee may also form subcommittees and delegate its authority to those subcommittees as it deems appropriate. Under the terms of its charter, the ESG Committee is authorized to engage independent advisors at the Company’s expense for advice on any matters within the scope of the ESG Committee’s duties. The ESG Committee may also form subcommittees and delegate its authority to those subcommittees as it deems appropriate. 30 2024 Proxy Statement Assists management with sourcing financing for potential acquisitions or other Company financing needs We Review the Company’s technical performance and plans, including long-term resource development strategies and new ventures Conduct and oversee correspondence with regulators, and monitor and engage with officials regarding proposed regulatory initiatives Under the terms of its charter, the Technical and Reserves Committee is authorized to engage independent advisors at the Company’s expense for advice on any matters within the scope of the Technical and Reserves Committee’s duties. The Technical and Reserves Committee may also form subcommittees and delegate its authority to those subcommittees as it deems appropriate. Meetings and Attendance In 2023, there were ten Board meetings, six Audit Committee meetings, five Compensation Committee meetings, four ESG Committee meetings, five Strategic Committee meetings, and five meetings of the Technical and Reserve Committee. In 2023, each director attended at least 75% of the meetings of the Board held during her or his period of service. In 2023, each committee member attended at least 75% of the meetings of each committee he or she was on. We do not have a Messrs. Fawthrop, Maxwell, Nze-Bekale, LaFehr and Ms. Stubbs each attended the 2023 Annual Meeting of Shareholders, 100% of the Board meetings in 2023, and 100% of the meetings of each committee on which he or she serves. Pursuant to our Corporate Governance Principles, executive sessions of non-management directors are to be held, at a minimum, in conjunction with each regularly scheduled Board meeting. Any director can request that an executive session be scheduled. The sessions are scheduled and presided over by the Chairman of the Board. 31 VAALCO Energy, Inc. Review and Approval of Related Person Transactions All of our employees and directors are expected to avoid situations and transactions that conflict with their ability to act in the best interests of VAALCO. This policy is included in our Code of Business Conduct and Ethics. Each director and executive officer is instructed to inform the Chairman of the Board and the Corporate Secretary when confronted with any situation that may be perceived as a conflict of interest. In addition, at least annually, each director and executive officer completes a detailed questionnaire specifying any business relationship that may give rise to a conflict of interest. The Audit Committee reviews all relevant information, including the amount of all business transactions involving VAALCO and entities with which the director is associated, and makes recommendations, as appropriate, to the Board as to whether a transaction involving an actual or perceived conflict of interest should be permitted. Under SEC rules, related party transactions are those in which the Company is a participant, the amount exceeds $120,000, and in which any “related person” has a direct or indirect material interest. Executive officers, directors, 5% beneficial owners of our common stock, and their respective immediate family members are considered to be related parties under SEC rules. Any related party transactions that occurred since the beginning of fiscal year 2023, and any currently proposed transactions, are required to be disclosed in this Proxy Statement. Other than with respect to Mr. Pruckl, the Company’s Chief Operating Officer, as discussed below, we are not aware of any related party transactions during 2023. The Audit Committee reviews and approves or ratifies any related person transaction that is required to be disclosed. In the course of its review and approval or ratification of a disclosable related person transaction, the Audit Committee considers: Any member of the Audit Committee who is a related person with respect to a transaction under review may not participate in the deliberations or vote for approval or ratification of the transaction. Related Party Transactions In 2023, J. Pruckl Holdings Ltd. (“Pruckl Holdings”), an entity owned and controlled by James Pruckl, the son of Thor Pruckl, our Chief Operating Officer, received approximately $190,030 in the aggregate for project contract services for the Company that include pipeline in-line data analysis, jacket structures and subsea pipeline inspections and other related services. 32 2024 Proxy Statement Director Compensation Overview Our compensation for non-employee directors is designed to be competitive with our peer group and to link rewards to business results and shareholder returns to align our directors’ interests with those of our shareholders. We do not have a retirement plan for non-employee directors. Mr. Maxwell, the only employee who serves as a director, is not paid additional compensation for his service on the Board or any committee. The Compensation Committee is responsible for evaluating and recommending to the independent members of the Board the compensation for non-employee directors, and the independent members of the Board set the compensation. As part of this review, the Compensation Committee considers the significant amount of time expended, and the skill level required, by each non-employee director in fulfilling his or her duties on the Board, each director’s role and involvement on the Board and its committees, and market data compiled from the Company’s peers and competitors. In 2023, the Compensation Committee also engaged Meridian Compensation Partners, LLC, to prepare an analysis of the compensation of our non-employee directors. No adjustments were made to non-employee director compensation in 2023. The following table sets forth our policy with respect to the annual cash compensation payable to our non-employee directors in 2023: (1) Payable in quarterly installments. Under our director compensation policy, each member of the Board is also entitled to an annual equity award in an amount determined by the independent members of the Board. For 2023, our independent directors determined to grant each then non-employee member of the Board equity awards with an aggregate grant date fair market value of $84,998, consisting of 20,286 shares of restricted common stock, with such restricted common stock vesting on the earlier of the first anniversary of the date of grant or the first annual meeting of shareholders following the date of grant (but in no event less than 50 weeks following the date of grant), subject to a continuous service requirement. We also reimburse directors for reasonable out-of-pocket expenses incurred in connection with the performance of their duties as directors, including travel expenses in connection with Board and committee meetings. We do not provide any perquisites to our directors. 33 VAALCO Energy, Inc. 2023 Non-Employee Director Compensation The following table shows compensation paid to each of our non-employee directors who served during the fiscal year ended December 31, 2023. 34 2024 Proxy Statement Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm Overview The Audit Committee has selected KPMG as the independent registered public accounting firm to audit the consolidated financial statements and the internal control over financial reporting of VAALCO and its subsidiaries for 2024. The Board has endorsed this appointment. KPMG has served as the Company’s independent registered public accounting firm since June 15, 2023. Representatives of KPMG will be present at the Annual Meeting and available to respond to questions. Although shareholder approval of this appointment is not required by law and is not binding on the Company, if our shareholders do not ratify the appointment of KPMG, the Audit Committee will consider the failure to ratify the appointment when appointing an independent registered public accounting firm for the following year. Even if our shareholders ratify the appointment of KPMG, the Audit Committee may, in its sole discretion, terminate KPMG’s engagement and direct the appointment of another independent registered public accounting firm at any time during the year. Information regarding fees billed by KPMG during 2023 is set forth below in “Fees Billed by Independent Registered Public Accounting Firm.” Vote Required The approval of the ratification of the appointment of KPMG as the Company’s independent registered public accounting firm requires a majority of votes cast affirmatively or negatively. For this proposal, abstentions will not be considered “votes cast” and will have no effect on the vote. Broker non-votes are not applicable to the proposal because your broker has discretionary authority to vote your shares of common stock in the absence of affirmative instructions from you with respect to this proposal. Board Recommendation The Board recommends that shareholders vote “FOR” the ratification of the appointment of KPMG as the Company’s independent registered public accounting firm. The proxy holders will vote all duly submitted proxies “FOR” the ratification of the appointment of KPMG as the Company’s independent registered public accounting firm unless duly instructed otherwise. 35 VAALCO Energy, Inc. Fees Billed by Independent Registered Public Accounting Firm Change of Independent Registered Public Accounting Firm On June 15, 2023, the Audit Committee of the Board of Directors of the Company approved the engagement of KPMG as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 and dismissed BDO USA, LLP (“BDO”) as the Company’s independent registered public accounting firm. The reports of BDO on the Company’s consolidated financial statements for the fiscal years ended December 31, 2022 and 2021 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the years ended December 31, 2022 and 2021 and the subsequent interim period through June 15, 2023 the Company had no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) with BDO on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to BDO’s satisfaction, would have caused BDO to make reference thereto in its reports on the Company’s financial statements for such years. In the fiscal years ended December 31, 2022 and 2021 and in the subsequent interim period through June 15, 2023, there were no “reportable events” (as defined in Item 304(a)(1)(v) of Regulation S-K), except that, as initially reported in Part II, Item 9A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the Securities and Exchange Commission on April 6, 2023, the Company reported four material weaknesses in its internal control over financial reporting during such period due to the Company not designing and maintaining effective controls over (i) accounting for leases, (ii) complex accounting for business combinations, (iii) financial reporting and consolidation, and (iv) accounting for income taxes. The Company previously provided BDO with a copy of the disclosures required by Item 304 of Regulation S-K contained in its Current Report on Form 8-K filed with the SEC on June 21, 2023, and requested that BDO furnish the Company with a letter addressed to the SEC stating whether BDO agreed with the statements made by the Company in response to Item 304(a) of Regulation S-K. A copy of BDO’s letter, dated June 21, 2023, is attached as Exhibit 16.1 to the Company’s Current Report on Form 8-K filed with the SEC on June 21, 2023. During the years ended December 31, 2022 and 2021 and the subsequent interim period through June 15, 2023, neither the Company nor anyone acting on the Company’s behalf consulted KPMG regarding: (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report nor oral advice was provided to the Company that KPMG concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue, or (ii) any matter that was either the subject of a disagreement as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions or a “reportable event” described in Item 304(a)(1)(v) of Regulation S-K. 36 2024 Proxy Statement Fees Paid to KPMG LLP Aggregate fees for professional services billed by KPMG to VAALCO during 2023 are as follows: Audit Fees For the year ended December 31, 2023, audit fees paid by us to KPMG were for the integrated audit of our annual financial statements and the review of our quarterly financial statements. Audit-Related Fees, Tax Fees and All Other Fees There were no audit-related fees, tax fees or other fees paid by us to KPMG for the year ended December 31, 2023. Fees Paid to BDO USA, LLP Aggregate fees for professional services billed by BDO to VAALCO during 2022 are as follows: Audit Fees For the year ended December 31, 2022, audit fees paid by us to BDO were for the integrated audit of our annual financial statements, registration statements, regulatory filings in the UK, and the review of our quarterly financial statements. Audit-Related Fees, Tax Fees and All Other Fees For the year ended December 31, 2022, audit-related fees paid by us to BDO were for the agreed upon procedures. There were no tax fees or other fees paid by us to BDO for the years ended December 31, 2022. 37 VAALCO Energy, Inc. Audit Committee Pre-Approval Policies and Procedures Our Audit Committee has in place pre-approval policies and procedures related to the provision of audit and non-audit services. Under these procedures, the Audit Committee pre-approves both the type of services to be provided by our independent registered public accounting firm and the estimated fees related to these services. During the approval process, the Audit Committee considers the impact of the types of services and the related fees on the independence of our independent registered public accounting firm. The services and fees must be deemed compatible with the maintenance of the independent registered public accounting firm’s independence, including compliance with SEC rules and regulations. Throughout the year, the Audit Committee also reviews any revisions to the estimates of audit and non-audit fees initially approved. During 2023 and 2022, all audit services provided by BDO and KPMG, as applicable, were pre-approved by the Audit Committee. In addition, during 2023 and 2022, no fees for services outside the audit or review were approved by the Audit Committee. 38 2024 Proxy Statement Audit Committee Report The Board has determined that all current Audit Committee members are (i) independent, as defined in Section 10A of the Exchange Act, (ii) independent under the standards set forth by the NYSE and (iii) financially literate. In addition, Ms. Stubbs qualifies as an audit committee financial expert under the applicable rules adopted under the Exchange Act. The Audit Committee is a separately designated standing committee of the Board, as defined in Section 3(a)(58)(A) of the Exchange Act and operates under a written charter approved by the Board, which is reviewed annually. Management is responsible for our system of internal controls and the financial reporting process. The Audit Committee is responsible for monitoring (i) the integrity of our financial statements, (ii) our compliance with legal and regulatory requirements, and (iii) the independence and performance of our independent registered public accounting firm. The Audit Committee has reviewed and discussed with management and the independent registered public accounting firm the audited consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2023, including a discussion of the quality, not just the acceptability, of the accounting principles applied, the reasonableness of significant judgments and the clarity of disclosures in the consolidated financial statements. Management represented to the Audit Committee that our consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America. The Audit Committee discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. Our independent registered public accounting firm also provided to the Audit Committee the written disclosure required by applicable rules of the PCAOB regarding the independent registered public accounting firms’ communications with the Audit Committee concerning independence. The Audit Committee discussed with the independent registered public accounting firm regarding such firm’s independence. Based on the Audit Committee’s discussions with management and the independent registered public accounting firm, and the Audit Committee’s review of the representations of management and the report of the independent registered public accounting firm to the Audit Committee, the Audit Committee recommended that the Board include the audited consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC. Audit Committee of the Board, Cathy Stubbs, Chair Andrew L. Fawthrop Fabrice Nze-Bekale The forgoing information contained in this Audit Committee Report and references in this Proxy Statement to the independence of the Audit Committee members shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. 39 VAALCO Energy, Inc. Proposal No. 3 Advisory Resolution on Executive Compensation Overview Pursuant to Section 14A(a)(1) of the Exchange Act, we are asking our shareholders to approve, on an advisory or non-binding basis, the compensation of our NEOs as disclosed in this Proxy Statement. The vote on this matter is not intended to address any specific item of compensation, but rather the overall compensation of our NEOs and the policies and practices described in this Proxy Statement. Our Board and the Compensation Committee believe that we maintain a compensation program that is tied to performance, aligns with shareholder interests, and merits shareholder support. Accordingly, we are asking our shareholders to approve the compensation of our NEOs as disclosed in this Proxy Statement by voting FOR the following resolution: “RESOLVED, that the Company’s shareholders approve, on an advisory basis, the compensation of the NEOs, as disclosed in the Company’s Proxy Statement for the 2024 Annual Meeting of Shareholders pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, the accompanying compensation tables and related narrative discussion.” Although this vote is non-binding, the Board and the Compensation Committee value the views of our shareholders and will review the results. If there are a significant number of negative votes, we will take steps to understand those concerns that influenced the vote, and consider them in making future decisions about executive compensation. Our Compensation Program We believe that our NEO compensation program described throughout the “Compensation Discussion and Analysis” aligns the interests of our executives with those of our shareholders. Our compensation programs are designed to provide a competitive level of compensation to attract, motivate and retain talented and experienced executives and reward our NEOs for the achievement of short- and long-term strategic and operational goals and increased TSR, while at the same time avoiding the encouragement of unnecessary or excessive risk-taking. We believe we have implemented a number of executive compensation practices and policies that reflect sound governance and promote the long-term interests of our shareholders. In connection with the shareholder outreach program discussed in this Proxy Statement, we have also conducted a comprehensive review of our compensation and other practices and the disclosures concerning them, and have taken several actions responsive to shareholder concerns. Vote Required The approval, on an advisory basis, of the compensation of our NEOs requires the vote of a majority of votes cast affirmatively or negatively. For this proposal, abstentions and broker non-votes will not be considered “votes cast” and will have no effect on the vote. If you own your shares through a broker, you must give the broker instructions to vote your shares with respect to the advisory vote on compensation of our NEOs if you wish for your shares to be voted. However, if you submit a proxy card, any proposals for which you do not provide instructions will be voted in accordance with the Board’s recommendation. Board Recommendation The Board recommends that shareholders vote “FOR” the approval, on an advisory basis, of the compensation of our named executive officers. 40 2024 Proxy Statement Executive Officers The following table provides information with respect to the named executive officers (“NEO”) of VAALCO. The following is a brief description of the background and principal occupation of each current non-director executive officer: Ronald Y. Bain Chief Financial Officer Age: 57 Ronald Y. Bain —Mr. Bain joined the Company in June 2021 and currently serves as Chief Financial Officer. Mr. Bain has over 25 years of oil and gas industry experience in a variety of roles across the supply chain and is a capital markets experienced chartered accountant (FCCA). Prior to working for the Company, Mr. Bain was Chief Financial Officer at Eland Oil & Gas Plc where he served on the board and on a variety of related company boards until the company was acquired by Seplat Petroleum Development Plc in December of 2019. Prior to working for Eland, Mr. Bain held a variety of Regional Accounting Directorship roles within the Baker flagship and Enterprise Finance Organization & Controller positions for both Baker Hughes and BJ Services over a 19-year period. Mr. Bain began his career at Donside Paper Company, starting as an Assistant Accountant and during his 9-year service rising through the Finance organization to the position of Finance Director. Mr. Bain qualified as a Chartered Accountant in 1993 with the Association of Certified Chartered Accountants where he is now a Fellow of the Association. He also holds certification from Corporate Financial Reporting Institute in Financial Modelling & Valuation Analyst, has certifications in International Financial Reporting (ACCA) and an award in Pension Trusteeship from the Pensions Management Institute. He attained a Scottish Higher National Certificate in Accounting at Aberdeen College of Commerce in 1987. 41 VAALCO Energy, Inc. Thor Pruckl Chief Operating Officer Age: 63 Thor Pruckl —Mr. Pruckl joined VAALCO in 2019 as Executive Vice President, International Operations to oversee activities in West Africa, Equatorial Guinea and Angola. Mr. Pruckl has over 30 years of domestic and international experience in both upstream and midstream operations and is well versed in both onshore and offshore operations from the seismic phase through to drilling and production. Mr. Pruckl has been deemed an expert witness in several arbitrations and hearings on well-site/facility design and operations. He started his career with BP Resources Canada, and later joined Talisman Energy managing their sour gas assets in Northern Canada. From 1999 through 2003 he was based in Southern Sudan, then returning to Canada to manage Talisman’s Northern Alberta assets. In 2006 Mr. Pruckl joined Nexen Energy and was based in Yemen managing Block’s 51 and 14 including their marine terminal and offshore mooring facilities. From 2009 through 2012, Mr. Pruckl re-joined Talisman Australasia managing the Papua New Guinea assets, and in 2013 he was assigned to Horizon Oil in Australia to begin project development and operations readiness on gas monetization projects planned for Papua New Guinea. Mr. Pruckl joined Noble in 2013 as their Asset Develop Director for Equatorial Guinea, and was heavily involved in the commissioning and startup of the Alen offshore facilities, In 2014 he became Country Manager & Vice President of Noble Equatorial Guinea, managing Nobles on and offshore assets. Mr. Pruckl holds an undergraduate degree in agriculture/engineering from the University of Saskatchewan, Canada and a Master’s degree in organizational leadership from Royal Roads University, Canada. Mr. Pruckl is a long-standing member of the Society of Petroleum Engineers. Matthew R. Powers Executive Vice President, General Age: 48 42 2024 Proxy Statement Jason J. Doornik Chief Accounting Officer Age: 54 Jason J. Doornik —Mr. Doornik joined the Company in June 2019 and serves as our Chief Accounting Officer. From March 2021 to June 2021, Mr. Doornik served as our interim Chief Financial Officer. Mr. Doornik has over 20 years of diversified accounting and finance experience, balanced among large companies and emerging companies as well as public accounting and industry experience. Prior to joining the Company, Mr. Doornik served as a consultant with Sirius Solutions from 2018 to May 2019. From 2015 to 2018, Mr. Doornik served as the Chief Accounting Officer and Controller of Fairway Energy, a Houston based midstream company. Prior to joining Fairway Energy, Mr. Doornik was hired by BPZ Resources, Inc. to serve as the Assistant Controller in November 2008 and was promoted to Corporate Controller in May 2011 where he served until October 2015. From June 2006 to April 2008 Mr. Doornik served as the Financial Reporting Manager of Grant Prideco, Inc. and its successor company, National Oilwell Varco, Inc. From June 2005 through June 2006, Mr. Doornik served a Senior Associate for The Siegfried Group. From August 1999 through June 2005, Mr. Doornik was employed by Ernst and Young LLP in the Assurance and Advisory practice and prior to that, from 1987 -1991, Mr. Doornik served as a Unit Supply Specialist in the US Army. Mr. Doornik received a Bachelor’s degree in Business Administration and a Master’s degree of Professional Accountancy from the University of Texas at Austin in August 1999. The biography of Mr. Maxwell, who currently serves as a director, is set forth above under “Proposal No. 1—Election of Directors— Director Nominee Information and Qualifications.” 43 VAALCO Energy, Inc. Compensation Discussion and Analysis Introduction Overview. The purpose of this Compensation Discussion and Analysis is to provide a clear understanding of our compensation philosophy and objectives, compensation-setting process, and 2023 compensation programs and decisions for our NEOs. For 2023, our NEOs were: Recent Performance Highlights Throughout 2023, we continued to deliver operationally and generate significant cash flow. Our 2023 results firmly place VAALCO in a financially stronger position, poised to execute accretive growth initiatives in the future. Key highlights of our business and our performance in 2023 and the first part of 2024 include: 2023 Full Year Highlights: 2024 Accomplishments to Date: 44 2024 Proxy Statement We strive to be a leading independent exploration and production company focused on supporting sustainable shareholder returns and growth. We have no bank debt and remain firmly focused on our strategic vision of achieving significant shareholder returns by maximizing the value of, and free cash flow from, our existing resource base, coupled with highly accretive inorganic growth opportunities. Compensation Program Objectives and Philosophy Our executive compensation program is intended to attract, retain and motivate high caliber executives who are committed to supporting the growth of our business, and to align our executives’ goals with those of our shareholders. Our compensation program is designed: It is the intention of the Compensation Committee to compensate our NEOs competitively, and to align performance-based incentives with shareholder interests. The Compensation Committee retains complete authority to determine the actual amounts paid to our NEOs. While we acknowledge and understand that some shareholders prefer to eliminate the Compensation Committee’s ability to exercise discretion, we believe that our fiduciary obligation to retain talent requires that we be able to respond to unforeseen circumstances that may occur after the annual bonus program is finalized, typically in early Spring. We note that in respect of 2023 bonuses, the Compensation Committee did not exercise their discretion to adjust bonuses to an amount higher than dictated by the plan. 45 VAALCO Energy, Inc. Highlights of Executive Compensation Practices Our executive compensation program includes a number of shareholder-friendly features that align with contemporary governance practices, promote alignment with our pay-for-performance philosophy and mitigate risk to our shareholders. The table below summarizes our key executive compensation practices, including practices that we do not follow: “Say on Pay” and Shareholder Outreach 46 2024 Proxy Statement 47 VAALCO Energy, Inc. Each year, we will continue to engage with our shareholders and listen to their feedback. We will discuss Company results, performance relative to industry trends, peer metrics, compensation plans, environmental, social and governance risks and initiatives, and the Company’s strategic direction. Determining Executive Compensation Designing Compensation to Reward Pay for Performance. Our compensation program is designed to reward performance that contributes to the achievement of our business strategy on both a short-term and long-term basis. In addition, we reward qualities such as: We also take into account labor market demands and tailor compensation to retain our talent. We believe that we ask more of a smaller group of leaders, with each executive having a broader role and impact than they otherwise might at other companies. Elements of Our Compensation Program. To accomplish our objectives, our compensation program is comprised of four elements: base salary, cash bonus, long-term equity-based compensation and benefits. The table below sets forth a summary of the principal elements of our compensation program and why we believe each form of compensation fits within our overall compensation philosophy: Our NEOs are entitled to participate in the standard employee benefit plans and programs generally available to our employees, including our 401(k) plan with matching contributions. 48 2024 Proxy Statement How We Determine Each Element of Compensation. In designing the Company’s executive compensation policies, the Compensation Committee considers pay as a whole, and there is no specific weight given to any particular component of compensation. The Compensation Committee reviews competitive market compensation data but does not set NEO compensation at any pre-determined percentile of competitive data that it reviews. In practice, the total direct compensation opportunity for each of our NEOs is based on many factors including competitive market data, the executive’s experience, importance of the role within the Company and the executive’s contribution to the Company’s long-term success. In addition, the Compensation Committee considers various measures of Company and industry performance, including Adjusted EBITDAX, WI Production (BOEPD), Net Income, revenue and cash flow from operations and other measures, in order to determine earned compensation for each of our NEOs. Role of the Compensation Committee. The Compensation Committee charter contains several important mandates: (i) to review and approve corporate goals and objectives relevant to the compensation of our executives; (ii) to evaluate our executives’ performance in light of those goals and objectives; (iii) to determine and approve our executives’ compensation level, including annual base salary, annual incentives and long-term incentives, based on such evaluation; and (iv) to exercise oversight with respect to the Company’s compensation philosophy, incentive compensation plans and equity-based plans. Role of the Independent Consultant. For 2023, the Compensation Committee continued to engage Meridian Compensation Partners, LLC (“Meridian”) as its independent consultant on executive compensation. Meridian’s engagement is to act as the Compensation Committee’s independent advisor on executive compensation, and in this role, Meridian assisted the Compensation Committee with requests from time-to-time throughout the year. The Compensation Committee did not direct Meridian to perform its services in any particular manner or under any particular method, and all decisions with respect to our executives compensation are made by the Compensation Committee. The Compensation Committee has the final authority to retain and terminate the compensation consultant and evaluates the consultant annually. The Company has no relationship with Meridian (other than the relationship undertaken by the Compensation Committee) and, after consideration of NYSE listing standards pertaining to the independence of compensation consultants, the Compensation Committee determined that Meridian is independent. Meridian does not provide any additional services to the Company. Role of Management. In the course of its review, the Compensation Committee considered the advice and input of the Company’s management. Specifically, the Compensation Committee leverages the Company’s management, human resources department and legal department to assist the Compensation Committee in the timely and cost-effective fulfillment of its duties. The Compensation Committee solicits input from the Chief Executive Officer and human resources department regarding compensation policies and levels. The legal department assists the Compensation Committee in the documentation of compensation decisions. The Compensation Committee does not permit members of the Company’s management to materially participate in the determination of their particular compensation, nor does the Compensation Committee permit the Chief Executive Officer or other members of management to be present for those portions of Compensation Committee meetings during which the particular member of the management team’s performance and compensation are reviewed and determined. Base Salary The Compensation Committee meets at least annually to review the base salaries of our executive officers. In setting base salaries, the Compensation Committee seeks to maintain stability and predictability from year-to-year, and usually makes percentage increases based on its view of the cost of living and competitive conditions for executive talent in the market. The Compensation Committee also considers subjective factors in setting base salary, including individual achievements, our performance, level of responsibility, experience, leadership abilities, increases or changes in duties and responsibilities and contributions to our performance. 49 VAALCO Energy, Inc. We believe that a significant portion of an NEO’s compensation should be variable, based on the performance of the Company. Accordingly, base salary is a minority portion of the overall total compensation of the NEOs. The following table provides information concerning the annual base salary of each of our NEOs: Annual Cash Incentive Bonus. Our NEOs, senior management and other non-management personnel have the potential to receive a meaningful cash bonus if annual financial and operational objectives or goals, pre-established by the Compensation Committee, are met and the Board approves the payment of bonuses. In determining the incentive bonuses earned, the Compensation Committee considers both Company and individual performance and, in its discretion, any other context or unforeseen circumstances that contributed to overall performance. Each executive has a pre-established target bonus opportunity, defined as a percentage of salary. Such executives can earn between 0% and 200% of that target opportunity based on Company and individual performance. The target bonus percentages for 2023 were as follows: The payout of each executive target bonus is based on Company performance and on individual performance. 50 2024 Proxy Statement Company Scorecards. Early in the fiscal year, the Compensation Committee approves an Executive and a Non-executive Scorecard that set various performance targets for corporate financial and non-financial measures for the current year. These performance measures are based in part on, and intended to align with, the annual operating budget, the financial forecast and the business plan approved by our Board shortly before or early in our fiscal year. The Compensation Committee assigns a different weight to each performance goal in the scorecards based on the relative importance of each performance target in light of the Company’s overall strategic goals for the year. For our executives, the overall achievement of VAALCO’s Non-executive Scorecard is a performance measure under the Executive Scorecard. Executive performance is evaluated on an individual basis with respect to the individual component of each executive officer’s incentive bonus, and an enterprise-wide basis with respect to the corporate component of each executive officer’s bonus that is dictated by the score on the Executive Scorecard. In early 2023, the Company established the Non-executive and Executive Scorecards for that year. The scorecards contained the performance goals (referred to as “metrics” in the scorecard) used to determine the corporate component of cash bonuses payable in 2024. The Compensation Committee assigns a “weight” to each metric. All metrics, added together, sum to 100%; the “weight” of an individual goal is its fraction of 100%. The Compensation Committee also sets three “ranges” for each performance goal: Threshold, Plan, and Stretch. The three ranges provide a benchmark for a multiplier that is applied to each metric to determine the final score with respect to that metric. Achieving Plan always results in a multiplier of 100%, such that, if Plan were achieved but not exceeded for every metric, the final score on the scorecard would be 100%. The Compensation Committee also determines a “Threshold” range which would result in a multiplier of 50%, and a “Stretch” range which would result in a multiplier of 150%. Multipliers below Threshold, above Stretch or between the named ranges are set a numeric value accordingly. The metrics in the Non-executive Scorecard are intended to be underpinned by goals that each employee can help to drive by executing on his or her individual responsibilities, in categories such as operations, cost containment, safety and employee development. The Executive Scorecards, by contrast, include metrics that executives are more directly responsible for, such as inorganic growth, Company strategy, and navigating particular important challenges that may arise from time to time. 51 VAALCO Energy, Inc. The 2023 scorecards, populated with results, are set forth below. 52 2024 Proxy Statement As seen in the above Non-executive Scorecard, the metrics were total recordable incident rate, an important HSE metric; employee development, as measured by participation in training; CO2e emission reduction; production rate, in working interest barrels of oil per day; operating expenditures per working interest barrel; cash flow from operations; proved reserves additions; and adjusted corporate general and administrative expenses. In assigning the relative weights to these metrics, the Compensation Committee considered driving near and long-term value to our shareholders through a combination of cost containment and efficient production, as well as the wellbeing of our employees and the environment. Our employees overachieved Plan on an aggregate level, resulting in an overall score of 112%. Executive Scorecard Remediation plan Audit tender Metrics for the 2023 Executive Scorecard were Non-executive Scorecard results; inorganic growth milestones; CAPEX targets; progress on the remediation of the material weaknesses in our internal control over financial reporting that were disclosed in our Annual Report on Form 10-K for 2022; business strategy optimization related to our Canadian business; and one metric we have redacted because the Company believes it to be in the best interests of our shareholders to preserve confidentiality with respect to this metric for strategic reasons. The Company commits, however, to discuss this redacted metric in next year’s Proxy Statement if they determine disclosure would not compromise strategic considerations at that time. 53 VAALCO Energy, Inc. Elements of Executive Compensation-Non-Executive Scorecard Results.The executive team is ultimately responsible for the performance of all employee stakeholders. Accordingly, each year, the Compensation Committee designates the Non-executive Scorecard results a component of the Executive Scorecard so that executive compensation is tied to all employees achieving company goals. The Compensation Committee weighted this metric as 15% of the executive team’s total score, and, given the overachievement of the non-executive goals (112%, versus 100% Plan), applied a multiplier of 112% to this metric. Inorganic Growth.As often noted in our filings, releases and investor presentations, the Board appointed George Maxwell as CEO three years ago with a mandate to grow the Company—in part through strategic inorganic opportunities. Since his assumption of the role, VAALCO has gone from a company with one producing asset to a company with producing assets in three countries. Given its paramount importance to the Company’s long-term strategy, the Compensation Committee weighted this metric at 25%—higher than any other individual metric. This past year VAALCO announced that it has signed an agreement to acquire Svenska, which would add an attractive producing asset in Cote d’Ivoire later this year. Because of the Company’s strong cash position, and in view of the Board and management’s belief, often cited in 2023, that VAALCO’s stock remained undervalued, the acquisition is structured as an all-cash deal which will have no dilutive effect on our shareholders. We anticipate this transaction to close in second quarter of this year. This acquisition had advanced far beyond a letter of intent by the time the scorecards were evaluated, and management worked assiduously to advance it to the stage of signing a share purchase agreement. The Board and Compensation Committee were very well pleased with management’s efforts in driving this deal to signing in a compressed time frame. Because that acquisition had not closed at the time the scorecards were evaluated, however, the Compensation Committee elected to apply the Threshold multiplier (50%) to this metric. CAPEX. When they approved the 2023 budget, the Board set a goal for capital expenditures not to exceed $69.8 million, and the Compensation Committee adopted this goal as Plan. While VAALCO is focused on growth and on increasing production, controlling spending remains critical to driving shareholder return, and the Compensation Committee weighted this goal at 10% of the total Executive Scorecard. Accrued CAPEX in 2023 was $72.6 million—four percent more than Plan. As noted above, numeric metrics that fall between Range benchmarks (in this case, between Threshold and Plan) normally receive a multiplier in between the applicable Ranges, and the Compensation Committee considered applying a multiplier greater than 50% in acknowledgment of the fact that the Threshold goal was exceeded by a more than twofold factor. In view of the importance of cost containment, and the relatively low weight assigned to this goal, the Compensation Committee elected to apply the 50% multiplier to this metric and not adjust it to a number between 50% and 100%. Remediation Framework.In March of 2023, the completion of our audit was delayed, we late filed our Annual Report on Form 10-K, and reported four material weaknesses in our internal control over financial reporting. Our shareholders expect more of us, and we expect more of ourselves and our management. Accordingly, we set a goal, weighted at 10%, that we have no material weaknesses or significant deficiencies in our internal control over financial reporting. We reported no material weaknesses or material deficiencies in connection with the audit of our 2023 financial statements, and, accordingly, the 150% multiplier was applied. Canada Business Unit. VAALCO, historically, has been an African-focused exploration and production company. With the business combination with TransGlobe Energy Corporation (“TransGlobe”) completed in 2022, an important focus was the integration and optimization of TransGlobe’s Canadian assets. In Spring of 2023, the Compensation Committee determined to set the implementation of a business strategy for the Company’s Canadian assets as a metric for the Executive Scorecard. 54 2024 Proxy Statement During 2023, in Canada, in accordance with the framework set by management, the Company increased lateral well lengths to favor predominantly 2.5 to 3 mile laterals, which allow for more efficient production; significantly reduced cycle times (the time that elapses from drilling to tie-in) by roughly 50%; and focused on a broad-based review of our Canadian land base to identify and execute on opportunities to build out drillable locations in accordance with out new focus. These efforts resulted in record production levels for our Canadian assets in 2023. The Compensation Committee accordingly applied the 150% Stretch multiplier to this metric. ERP Goals.To help drive our constant efforts to improve efficiency and compliance goals, and particularly in view of the necessity to integrate the assets acquired in the business combination with TransGlobe, the Company prioritized the implementation of a state-of-the-art ERP software system. The weight assigned to this metric (15%) reflects the importance that the Board and the Compensation Committee attach to this goal. The ERP system was selected in September of 2023, and the plan was implemented commencing in November 2023 and is well underway. Accordingly, the Compensation Committee applied the 100% Plan multiplier to this metric. Redacted Goal.As noted above, we are unable to disclose, this year, specifics about one of our metrics due to the need to keep it confidential for strategic reasons. We are able to disclose that the weight of this metric was 15%, and the multiplier applied was 100%. TSR Modifier/Peer Group.As seen in the table above, the total raw score achieved by our executive team per the 2023 scorecard criteria was 94 out of 100. Each year, after tabulating the total raw score, the Compensation Committee calculates and applies a TSR Modifier by comparing the 30-day value weighted average price (“VWAP”) of the Company’s share price in the last 30 trading days of the year for the same period in the prior year, as well as factoring in cash returned to shareholders in the form of dividends and share buybacks. The Compensation Committee also compares the performance of the Company by these measures with the performance of the companies identified as our peers over the same time period. The bonus payout is capped, such that even if the raw score and TSR Modifier dictates a bonus payout of more than 200% of the executive’s target, no executive can earn more than 200% of his or her target. The TSR Modifier is calculated as set forth below: The TSR Modifier seeks to capture how the return to VAALCO’s shareholders over the year in question compared to the return to shareholders of the companies the Compensation Committee believe to be most comparable to VAALCO, from the standpoint of our operations and investment profile. 55 VAALCO Energy, Inc. The Compensation Committee has identified the defining characteristics of such peer companies to be one, that each be an independent oil and gas producer; two, that each have a geographic focus similar to VAALCO’s; and three, that each be of a size that render comparison to VAALCO meaningful. The Compensation Committee believes that these three factors constitute some of the most important metrics that investors in our industry consider from the standpoint of focus, risk, and return, that are also readily available and quantifiable. For 2023 bonuses, the peer group identified by our Compensation Committee were Afentra PLC, Africa Oil Corp., BW Energy Ltd., Capricorn Energy PLC, Kosmos Energy Ltd., Orca Exploration Group Inc. Class B, Panoro Energy ASA, Pharos Energy, PLC, Seplat Petroleum and Tullow Oil plc. Each of these companies is an independent oil and gas producer with a strong focus on African or Egyptian assets. The average (mean) market capitalization of these peer companies was $740 million at the end of 2022, with the largest being just under $3 billion and the smallest $67 million. From the prior year, Capricorn and Pharos were added for their Egypt focus due to the Company’s acquisition in Q4 2022 of Egyptian assets in its business combination with TransGlobe. Additionally, the Compensation Committee added Afentra and dropped SDX Energy, Inc., as the former company was more relevant geographically (West African focused verses North Africa), from a production standpoint (oil exploration and development verses primarily gas), and from the standpoint of market capitalization. With respect to company size, the Compensation Committee seeks to avoid overrepresentation of companies with revenues 2.5 times greater, or 2.5 times less than, VAALCO’s revenues. Out of the ten peer companies selected last year, three had revenues more than 2.5 times that of VAALCO’s, and two had revenues 2.5 times less than VAALCO’s. The Compensation Committee elected to keep all five in the peer group in view of the fact that having too few companies as peers could lead to greater impact on the TSR modifier as a result of any anomalous factors for any single company in any given year. (As for bonuses paid in 2024 (attributable to the 2023 calendar year), eliminating all five would have placed the Company in the top position, vis-à-vis all remaining peers, as measured by TSR.) 56 2024 Proxy Statement For 2023, the 30-day VWAP of the Company’s total return did not increase year end to year end, but our total return performance was in the top half of our selected peer group. Accordingly, the TSR resulted in an overall modifier of 100%, and neither increased nor decreased the raw score of the Executive Scorecard. As noted on page 46, a significant number of shareholders whom we met with identified the TSR Multiplier as an area of particular interest. A significant minority (2.99%) expressed concern that the Company take appropriate steps to avoid too strong an emphasis on share price over other performance goals in our executive compensation program, while a larger percentage (4.53%) singled out the TSR Modifier as a component of executive compensation that they particularly favored. The Committee believes it to be in our shareholders’ best interests to align executive compensation with the performance of the Company’s stock, and believes it is also important that the executive compensation program not incent executives to focus on stock price performance to the detriment of other important business metrics. The goal in designing the program is to motivate executives to produce positive short- and long-term corporate results, without motivating them to take unnecessary or excessive risks in doing so. The Committee believes that having share price taken into account by means of a multiplier of metrics that are not derived from share price, coupled with the balancing effect of weighing our share price increase (or decrease) against performance of our peers, strikes the appropriate balance. With respect to the individual performance component of the Company’s annual incentive bonuses, the Compensation Committee evaluates the performance of each executive officer in light of the goals set forth in the Executive Scorecard, taking into account the specific duties and responsibilities of each officer. In addition, the Compensation Committee considers each executive officer’s performance with respect to his or After combining the corporate performance (that is, the score from the scorecard) and the individual performance components of the annual incentive bonuses, each of which was given equal weight, our Compensation Committee determined that our NEOs would receive the following bonuses for their performance during 2023: Our annual incentive bonuses were paid in March 2024. 57 VAALCO Energy, Inc. Long-Term Equity-Based Incentives Overview and 2023 Equity Compensation.We believe formal long-term equity incentive programs are valuable compensation tools and are consistent with the compensation programs of the companies in our peer group. We maintain (i) the 2020 Long Term Incentive Plan (as amended, the “2020 LTIP”), which permits the grant of stock, options, restricted stock, restricted stock units, phantom stock, SARs and other awards, any of which may be designated as performance awards or be made subject to The Compensation Committee administers our long-term incentive plans. The Committee confirms eligible recipients, determines grant type timing, assigns the number of shares subject to each award, fixes the time and manner in which awards are exercisable and sets exercise prices and vesting and expiration dates. For compensation decisions regarding the grant of equity compensation to executive officers, our Compensation Committee considers recommendations from our Chief Executive In general, our Compensation Committee attempts to provide a mix of awards to our executives that is appropriately balanced between incentivizing performance and retention. For 2023, our Compensation Committee determined to grant our NEOs a mix of restricted stock and stock options with performance hurdles, thereby encouraging high-level performance by our executives and aligning their interests with those of our shareholders, and awards of restricted stock with service-based vesting requirements that vest ratably over three years, promoting long-term retention of our NEOs. Equity awards are generally granted to our NEOs and other employees on an annual basis. The Compensation Committee determines the actual award values at its discretion based on individual factors including the individual’s previous and expected future performance, level of responsibilities, retention considerations and internal parity. 58 2024 Proxy Statement Based on these factors, the Compensation Committee determined to grant the following equity incentive awards to our NEOs in 2023: The vesting of our equity awards is generally contingent on continued service. However, vesting of awards is generally accelerated in the event of a change of control. For additional information, see “Executive Compensation—Potential Payments upon Termination or Change in Control” below. The equity awards granted to our NEOs are subject to forfeiture in accordance with the terms of the grant agreements if the executive terminates employment before the award vests, the executive is terminated for cause, or the executive otherwise fails to comply with the terms of his or her award agreement. Benefits We provide company benefits that we believe are standard in the industry to all of our employees, including our NEOs. These benefits consist of a group medical and dental insurance program for employees and their qualified dependents, the majority of which is currently paid for by the Company, and a 401(k) employee savings plan. We also currently make matching contributions to our 401(k) plan of up to 6% of each participant’s salary. The Company pays all administrative costs to maintain the 401(k) plan. We do not provide employee life insurance amounts surpassing the Internal Revenue Service maximum. 59 VAALCO Energy, Inc. Employment Agreements We utilize employment agreements to retain and attract highly qualified executive officers in a competitive market. We currently have employment agreements with Mr. Maxwell, our Chief Executive Officer, Mr. Bain, our Chief Financial Officer, Mr. Pruckl, our Chief Operating Officer, and Mr. Powers, our Executive Vice President and General Counsel. We do not have an employment agreement with Mr. Doornik, our Chief Accounting Officer. See “—Severance and Change in Control Payments” below for additional information. George W. M. Maxwell —In connection with the appointment of Mr. Maxwell as our Chief Executive Officer, we entered into an employment agreement effective as of April 19, 2021, which was amended on January 27, 2022 and November 1, 2022, (as amended, the “Maxwell Employment Agreement”), pursuant to which Mr. Maxwell is entitled to receive an annual base salary of $550,000. The Maxwell Employment Agreement also provides that Mr. Maxwell is eligible to receive an annual cash bonus with a target percentage equal to 100% of his base salary and stock options and other long-term incentive awards up to 150% of his base salary. Pursuant to the Maxwell Employment Agreement, the Company pays Mr. Maxwell $22,000 per year for health benefits and $17,000 per year for pension benefits and provides other customary employment benefits, including paid vacation and sick leave. Ronald Y. Bain —In connection with the appointment of Mr. Bain as Chief Financial Officer, we entered into an employment agreement with Mr. Bain effective as of June 18, 2021, which was amended on January 27, 2022 and November 1, 2022 (as amended, the “Bain Employment Agreement”). Pursuant to the Bain Employment Agreement, Mr. Bain is entitled to receive an annual base salary of $400,000. The Bain Employment Agreement also provides that Mr. Bain is eligible to receive an annual cash bonus with a target percentage equal to 75% of his base salary and stock options and other long-term incentive awards up to 75% of his base salary. Pursuant to the Bain Employment Agreement, the Company pays Mr. Bain $22,000 per year for health benefits and $17,000 per year for pension benefits, and provides other customary employment benefits including paid vacation and sick leave. Thor Pruckl —In connection with the appointment of Mr. Pruckl as Chief Operating Officer, we entered into an employment agreement, on February 6, 2024 that has been subsequently amended and restated (the “Pruckl Employment Agreement”). Pursuant to the Pruckl Employment Agreement, Mr. Pruckl is entitled to receive an annual base salary of $400,000, which shall be reviewed annually by the Compensation Committee, and may be increased, but not decreased, at the discretion of the Compensation Committee. The Pruckl Employment Agreement also provides that Mr. Pruckl is eligible to receive an annual cash bonus with a target percentage equal to 75% of his base salary and stock options and other long-term incentive awards up to 75% of his base salary. Pursuant to the Pruckl Employment Agreement, for so long as Mr. Pruckl’s principal place of employment is in Houston, Texas, Mr. Pruckl will receive furnished leased housing and a leased vehicle with additional payments the Company to cover any withholding taxes due in connection therewith. Pursuant to the Pruckl Employment Agreement, the Company pays Mr. Pruckl $17,000 per year for pension benefits, and provides other customary employment benefits including paid vacation and sick leave. Matthew R. Powers —We entered into an employment agreement, dated January 18, 2024 (the “Powers Employment Agreement”) with Mr. Powers, our Executive Vice President and General Counsel. Pursuant to the Powers Employment Agreement, Mr. Powers is entitled to receive a minimum annual base salary of $350,000, which shall be reviewed annually by the Compensation Committee and may be increased, but not decreased, at the discretion of the Compensation Committee. The Powers Employment Agreement also provides that Mr. Powers is eligible to receive an annual cash bonus in an amount to be determined by the Compensation Committee, based on performance goals established by the Compensation Committee and with a target percentage equal to 75% of his base salary. Mr. Powers is eligible to receive stock options and other incentive awards on a basis no less favorable than the process and approach used for the Company’s other senior executives, and his annual long-term incentive award is up to fifty percent (50%) of his base salary. In addition, Mr. Powers is entitled to other customary employment benefits, including reimbursement for business and entertainment expenses and paid vacation. 60 2024 Proxy Statement We believe that employment agreements ensure continued dedication of executives in case of personal uncertainties or risk of job loss and ensure that compensation Severance and Change in Control Payments We believe that an important aspect of attracting and retaining qualified individuals to serve as executive officers involves providing market termination protection benefits. In May 2019 we adopted a form of change in control agreement for certain of our executives that provides for certain benefits upon a termination following a change in control. For additional information, see “Executive Compensation—Potential Payments upon Termination or Change in Control.” Perquisites and Indemnification We do not typically provide perquisites to our NEOs that are not available to employees generally. Pursuant to our organizational documents, we are required to indemnify, to the fullest extent permitted by applicable law, any person who was or is made, or is threatened to be made, a party, or is otherwise involved in any action, suit, or proceeding, whether civil, criminal, administrative, or investigative, by reason of the fact that he or she, or a person for whom he or she is a legal representative, is or was a director or an officer of the Company, including our NEOs. From time to time, we may provide perquisites for recruitment or retention purposes, or in connection with a relocation. Mr. Pruckl was asked to relocate from Gabon to the United States in connection with his promotion to Chief Operating Officer in late 2022, and, as is reflected in the Summary Compensation Table Other Compensation Information Prohibition on Hedges and Pledges.Our insider trading policy prohibits hedging and pledging transactions and broadly applies to all directors, officers and employees of the Company. Such persons are prohibited from (i) executing transactions in Company securities that involve puts, calls or other derivative securities on an exchange or other organized market, (ii) holding Company securities in margin accounts or pledging the Company securities as collateral for loans or other obligations, without the prior consent of the Board, or (iii) engaging in hedging transactions with respect to Company securities, including trading in any derivative security, zero-cost collars, forward sale contracts, or other forms of hedging or monetization transactions, including those that allow such person to own the securities without the full risks and rewards of ownership. Assessment of Risk.It is important to Stock Ownership Guidelines.We have adopted stock ownership guidelines that 61 VAALCO Energy, Inc. Accounting and Tax Considerations.We may from time to time pay Section 409A of the Code sets forth limitations on the deferral and payment of certain benefits. Generally, the Compensation Committee intends to administer our executive compensation program and design individual compensation components, and the compensation plans and arrangements for our employees generally, so that Recoupment Policy.For many years, we have had in place a clawback policy that provide for the recoupment or forfeiture of 62 2024 Proxy Statement Compensation The Compensation Committee of the Company has reviewed and discussed the foregoing Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, the Compensation Committee recommended to the Board that the foregoing Compensation Discussion and Analysis be included in the Company’s Proxy Statement for the 2023 annual meeting of shareholders, and also incorporated by reference in the Company’s Annual Report on Form 10-K for the year Compensation Committee of Edward LaFehr Cathy Stubbs The information contained in this Compensation Committee Report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities VAALCO Energy, Inc. Executive Compensation The following sets forth the annual compensation elements of VAALCO’s 64 2024 Proxy Statement 65 VAALCO Energy, Inc. Grants of Plan-Based Awards during The following table presents grants of plan-based 66 2024 Proxy Statement Page intentionally left blank. 67 VAALCO Energy, Inc. Outstanding Equity Awards at The following table sets forth specific information with respect to unexercised options and unvested awards for each of our Number of securities underlying unexercised options (#) exercisable Number of securities underlying unexercised options (#) unexercisable Option exercise price ($) Option expiration date Number of shares or units or stock that have not vested (#) Market value of shares or units of stock that have not vested ($) 68 2024 Proxy Statement 69 VAALCO Energy, Inc. Option Exercises and Stock Vested During the Fiscal Year Ended December 31, The following table sets forth specific information with respect to each exercise of stock options and each vesting of restricted stock during Pension Benefits Table We do not Nonqualified Deferred Compensation We do not contribute to any nonqualified deferred compensation benefit plan or program, or under any contract that would provide deferred compensation benefits. Potential Payments Capitalized terms used in this section and not otherwise defined in this Proxy Statement can be found in the applicable agreement attached as an Exhibit to our most recent Annual Report on Form 10-K, filed with the SEC on March 15, 2024, as amended on March 18, 2024. NEO Employment Agreements. On April 19, 2021, we entered into the Maxwell Employment Agreement with Mr. Maxwell, which was amended on January 27, 2022 and November 1, 2022, and provides that upon termination of Mr. Maxwell’s employment for any reason, Mr. Maxwell will be entitled to receive (i) the base salary earned before the Termination Date, (ii) his accrued and unused vacation days through the Termination Date and (iii) any unreimbursed reasonable business expenses that were incurred but unpaid as of the Termination Date. Upon an involuntary termination of Mr. Maxwell’s employment by the Company except for Cause, by Mr. Maxwell for Good Reason, or due to Mr. Maxwell’s death or disability, the Company will pay Mr. Maxwell additional compensation equal to 50% of his annual base salary then in effect plus 50% of the greater of (i) his average annual bonus paid or payable for the preceding two calendar years and (ii) the annual bonus for the calendar year in which the termination occurs (prorated for the portion of the year actually worked). These benefits are subject to his signing a release in favor of the Company and complying with certain other covenants. If a Change in Control occurs and Mr. Maxwell is terminated during a specified period preceding or following the Change in Control, then under certain circumstances the Company will pay Mr. Maxwell additional compensation equal to 150% of his annual base salary then in effect plus 150% of the greater of (i) his average annual bonus paid or payable for the preceding two calendar years and (ii) the annual bonus for the calendar year in which the termination occurs (prorated for the portion of the year actually worked). 70 2024 Proxy Statement On June 18, 2021, we entered into the Bain Employment Agreement with Mr. Bain, which was amended on January 27, 2022 and November 1, 2022 and which provides that upon termination of Mr. Bain’s employment for any reason, Mr. Bain will be entitled to receive (i) the base salary earned before the Termination Date, (ii) his accrued and unused vacation days through the Termination Date and (iii) any unreimbursed reasonable business expenses that were incurred but unpaid as of the Termination Date. The Bain Employment Agreement provides that, upon an involuntary termination of Mr. Bain’s employment by the Company except for Cause, by Mr. Bain for Good Reason, or due to Mr. Bain’s death or disability, the Company will pay Mr. Bain additional compensation equal to 50% of his annual base salary then in effect plus 50% of the greater of (i) his average annual bonus paid or payable for the preceding two calendar years and (ii) the annual bonus for the calendar year in which the termination occurs (prorated for the portion of the year actually worked). If a Change in Control occurs and Mr. Bain is terminated during a specified period preceding or following the Change in Control, then under certain circumstances, the Company will pay Mr. Bain additional compensation equal to 100% of his annual base salary then in effect plus 100% of the greater of (i) his average annual bonus paid or payable for the preceding two calendar years and (ii) the annual bonus for the calendar year in which the termination occurs (prorated for the portion of the year actually worked). The Pruckl Employment Agreement provides that upon termination of Mr. Pruckl’s employment for any reason, Mr. Pruckl will be entitled to receive (i) the base salary earned through the Termination Date (as defined in the Pruckl Employment Agreement), (ii) his accrued and unused vacation days through the Termination Date and (iii) any unreimbursed reasonable business expenses that were incurred but unpaid as of the Termination Date. The Pruckl Employment Agreement provides that, upon an involuntary termination of Mr. Pruckl’s employment by the Company except for Cause (as defined in the Pruckl Employment Agreement), by Mr. Pruckl for Good Reason (as defined in the Pruckl Employment Agreement), or due to Mr. Pruckl’s death or disability, the Company will pay Mr. Pruckl additional compensation equal to 50% of his annual base salary then in effect plus 50% of the greater of (i) his average annual bonus paid or payable for the preceding two calendar years and (ii) the annual bonus for the calendar year in which the termination occurs calculated at the Incentive Target Percentage, as defined therein (prorated for the portion of the year actually worked), as well as provide for continued group health plan coverage for Mr. Pruckl, his eligible spouse and other dependents for a period of one year following termination. If a Change in Control (as defined in the Pruckl Employment Agreement) occurs and Mr. Pruckl is terminated during a specified period preceding or following the Change in Control, then under certain circumstances, the Company will pay Mr. Pruckl additional compensation equal to 100% of his annual base salary then in effect plus 100% of the greater of (i) his average annual bonus paid or payable for the preceding two calendar years and (ii) the annual bonus for the calendar year in which the termination occurs calculated at the Incentive Target Percentage, as defined therein (prorated for the portion of the year actually worked). The Powers Employment Agreement provides that upon termination of Mr. Powers’ employment for any reason, Mr. Powers will be entitled to receive (i) the base salary earned before the Termination Date (as defined in the Powers Employment Agreement), (ii) his accrued and unused vacation days through the Termination Date and (iii) any unreimbursed reasonable business expenses that were incurred but unpaid as of the Termination Date. The Powers Employment Agreement provides that, upon an involuntary termination of Mr. Powers’ employment by the Company except for Cause (as defined in the Powers Employment Agreement), by Mr. Powers for Good Reason (as defined in the Powers Employment Agreement), or due to Mr. Powers’ death or disability, the Company will pay Mr. Powers additional compensation equal to 50% of his annual base salary then in effect plus 50% of the greater of (i) his average annual bonus paid or payable for the preceding two calendar years and (ii) the annual bonus for the calendar year in which the termination occurs calculated at the Incentive Target Percentage, as defined therein (prorated for the portion of the year actually worked), as well as provide for continued group health plan coverage for Mr. Powers, his eligible spouse and other dependents for a period of one year following termination. If a Change in Control (as defined in the Powers Employment Agreement) occurs and Mr. Powers is terminated during a specified period preceding or following the Change in Control, then under certain circumstances, the Company will pay Mr. Powers additional compensation equal to 100% of his annual base salary then in effect plus 100% of the greater of (i) his average annual bonus paid or payable for the preceding two calendar years and (ii) the annual bonus for the calendar year in which the termination occurs calculated at the Incentive Target Percentage, as defined therein (prorated for the portion of the year actually worked). 71 VAALCO Energy, Inc. Change In Control Agreements. In May 2019, our Board adopted a form of change in control agreement for certain of our executive officers and other associates of the Company. The form was adopted to provide a uniform framework of severance benefits to our key employees and leadership team following a change in control. Under the change in control agreement, upon the termination of a participant’s employment by the Company without cause or a resignation by the participant for good reason three months prior to a change in control or six months following a change in control, the participant will be entitled to receive: Any payments under the change in control agreement are subject to the participant’s execution and non-revocation of a general waiver and release of claims against the Company. Mr. Doornik is the only NEO who is party to a change in control agreement. Potential Payments upon Termination or Change in Control Table. The following table sets forth the incremental compensation that would be payable by us to The analysis contained in this section does not consider or include payments made to 72 2024 Proxy Statement The table below indicates the Chief Executive Officer As required by Section 953(b) of the For the Company’s employees in Gabon, amounts were converted from Central African CFA franc to U.S. dollars using an exchange rate of 606.56 Central African CFA francs to 1.00 U.S. dollar, which was the average exchange rate in 2023. For the Company’s employees in Egypt, amounts were converted from Egyptian pound to U.S. dollars using an exchange rate of 30.56 Egyptian pound to 1.00 U.S. dollar, which was the average exchange rate in 2023. For the Company’s employees in Canada, amounts were converted from Canadian dollar to U.S. dollars using an exchange rate of 1.35 Canadian dollar to 1.00 U.S. dollar, which was the average exchange rate in 2023. To determine median employee compensation, we took the following steps: 74 2024 Proxy Statement Pay Versus Performance As required by Item 402(v) of Regulation S-K, the Company is providing the following information regarding the relationship between executive compensation and the Company’s financial performance for each of the The following table summarizes compensation values reported in the Value of Initial Fixed $100 Investment Based on: 75 VAALCO Energy, Inc. 76 2024 Proxy Statement (5) Adjusted EBITDAX is a non-GAAP financial measure and is described under “Non-GAAP Financial Measures.” Relationship Between Pay and Performance As described in greater detail in “Compensation Discussion and Analysis,” the Company’s executive compensation program reflects a pay-for-performance philosophy that utilizes a number of short-term and long-term performance measures, not all of which are presented in the table above or graphs below. The Company generally seeks to incentivize long-term performance, and therefore does not specifically align the 77 VAALCO Energy, Inc. Description of The Description of Relationship Between PEO and Other NEO Compensation Actually Paid and Net Income The following chart sets forth the relationship between Compensation Actually Paid to our PEO and the average of Compensation Actually Paid to our other NEOs, and Net Income over the four most recently completed fiscal years. 78 2024 Proxy Statement Description of Relationship Between PEO and Other NEO Compensation Actually Paid and Adjusted EBITDAX The following chart sets forth the relationship between Compensation Actually Paid to our PEO and the average of Compensation Actually Paid to our other NEOs, and Adjusted EBITDAX over the four most recently completed fiscal years. Most Important Financial Performance Measures for Fiscal Year 2023 The following is an unranked list of the four most important financial performance measures used to link executive compensation actually paid to our NEOs during the fiscal year 2023 with the 79 VAALCO Energy, Inc. Security Ownership of Certain Beneficial Owners and Management The following table shows the ownership interest in Company stock as of April * Less than 1% 80 2024 Proxy Statement Proposal No. 4 Approval of an Amendment to the 2020 LTIP to Increase the Number of Shares Reserved for Issuance Pursuant to Awards Under the 2020 LTIP Overview We are seeking shareholder approval of an amendment to the Company’s 2020 Long Term Incentive Plan (the “2020 LTIP”) to increase the number of shares authorized for issuance pursuant to awards under the 2020 LTIP by 5,500,000 shares, for a total number of 14,750,000 shares authorized (the “LTIP Amendment”). Our Board of Directors adopted the LTIP Amendment on April 19, 2024 upon the recommendation of our Compensation Committee, subject to shareholder approval. Our Board and our Compensation Committee approved the LTIP Amendment because they believe that the number of shares of common stock currently available under the 2020 LTIP is insufficient to meet our future equity compensation needs. The 2020 LTIP provides for the granting of incentive stock options, nonqualified stock options, stock appreciation rights, restricted stock, restricted stock units, performance awards, dividend equivalent rights, and other awards, which may be granted singly, in combination, or in tandem, and which may be paid in cash or shares of our common stock. The Board believes it desirable to increase the number of shares available for issuance under the 2020 LTIP in order to (i) continue to promote shareholder value by providing appropriate incentives to key employees and certain other individuals who perform services for our Company and (ii) continue awarding our non-employee directors with stock options, restricted stock and other forms of equity compensation as a means to retain capable directors and attract and recruit qualified new directors in a manner that promotes ownership of a proprietary interest in our Company. The following table provides information regarding shares available for issuance under the 2020 LTIP: The purpose of the LTIP Amendment is to increase the number of shares of common stock that we may issue pursuant to awards under the 2020 LTIP by 5,500,000 shares. 81 VAALCO Energy, Inc. Based on historical equity grant practices and our expectations regarding our growth, we estimate that if the LTIP Amendment is not approved by our shareholders at the Annual Meeting, the number of shares currently reserved for issuance pursuant to awards under the 2020 LTIP will be insufficient to make even one Company-wide grant of equity awards to eligible participants. If our shareholders do not approve the LTIP Amendment at the Annual Meeting, the 2020 LTIP will continue in effect in its current form as the framework for our equity incentive compensation program until the shares of common stock reserved for issuance thereunder are exhausted. At that time, we will lose an important compensation tool that is designed to attract, motivate and retain highly qualified talent and more closely align our employees’ interests with our shareholders’ interests. If the LTIP Amendment is approved by our shareholders at the Annual Meeting, we intend to file, pursuant to the Securities Act, a registration statement on Form S-8 to register the additional shares available for issuance under the 2020 LTIP, as well as previously issued shares that have been forfeited and returned to the 2020 LTIP. We believe the LTIP Amendment is essential to the Company’s future success and encourage shareholders to vote in favor of its approval. Determination of Share Increase In evaluating the advisability of the LTIP Amendment and determining the size of the proposed increase, the Compensation Committee and the Board of Directors considered a number of factors, including the following: Importance of Long-Term Equity Incentives. Long-term equity incentives are a significant component of our executive compensation program because they provide flexibility to our compensation methods in order to adapt the compensation of our key employees, key contractors, and outside directors to a changing business environment, after giving due consideration to competitive conditions and the impact of applicable tax laws. Long-term equity incentives also motivate executives to make decisions that focus on creating long-term value for shareholders. As illustrated above under “Executive Compensation—2023 Summary Compensation Table,” equity awards accounted for approximately 41.7% of our Chief Executive Officer’s total compensation in 2023 and approximately 20.8%, on average, of the total compensation for each of our other NEOs in 2023. Equity incentives are also an important part of our compensation program for non-executive employees. The ability to continue to grant equity compensation is vital to our employee recruitment and retention efforts. Burn Rate and Dilution Analysis. We are committed to managing the use of equity incentives prudently and maintaining a balance between the benefits that equity compensation brings to our compensation program and the dilutive effect the awards have on our shareholders. In evaluating the proposed LTIP Amendment, the Compensation Committee and the Board of Directors reviewed various metrics, such as dilution and burn rate, in the context of our historical equity compensation practices as well as the expected impact of the proposed LTIP Amendment. The potential dilution from the proposed share increase is 5.3%, based on the total number of shares of common stock outstanding as of April 12, 2024. We manage dilution by limiting the aggregate number of shares that we grant each year pursuant to awards under the 2020 LTIP, which is commonly referred to as “burn rate.” Burn rate is a measure that is used to show how quickly a company is depleting the shares reserved for issuance under its equity compensation plan. Burn rate is defined as, in a given fiscal year, the number of shares subject to time-based equity granted and performance-based equity awards earned and vested, divided by the weighted average number of shares outstanding. 82 2024 Proxy Statement The following table sets forth our annual dilution, burn rate and overhang in 2023. Expected Duration. We estimate that the shares reserved for issuance pursuant to awards under the proposed LTIP Amendment should be sufficient to fund an additional three years (2024 through 2026) of Company-wide grants of equity awards to eligible participants, including our NEOs and non-employee directors, assuming that we continue to grant awards consistent with our historical usage, but noting that future circumstances may require us to change our practices. Expectations regarding future share usage could be impacted by a number of factors, including but not limited to hiring and promotion activity, the future price of our common stock and the rate at which shares are returned to the 2020 LTIP reserve upon forfeiture of awards. While we believe that our underlying assumptions are reasonable, future share usage may differ from current expectations. 83 VAALCO Energy, Inc. Text of the Amendment The LTIP Amendment increases the maximum number of shares of common stock that we may issue pursuant to awards under the 2020 LTIP by 5,500,000 shares, from 9,250,000 shares to 14,750,000 shares. To reflect such increase, Section 5.1 of the 2020 LTIP would be amended and restated in its entirety as follows: “5.1 Number Available for Awards. Subject to adjustment as provided in Articles 11 and 12, the maximum number of shares of Common Stock that may be delivered pursuant to Awards granted under the Plan is Fourteen Million, Seven Hundred Fifty Thousand (14,750,000) shares plus any Prior Plan Awards, of which up to one million (1,000,000) shares may be delivered pursuant to Incentive Stock Options. Shares to be issued may be made available from authorized but unissued Common Stock, Common Stock held by the Company in its treasury, or Common Stock purchased by the Company on the open market or otherwise. During the term of this Plan, the Company will at all times reserve and keep available the number of shares of Common Stock that shall be sufficient to satisfy the requirements of this Plan.” New Plan Benefits All awards to employees, officers, contractors and outside directors under the 2020 LTIP, as amended, will be made at the discretion of the Compensation Committee. We cannot currently determine the benefits or number of shares subject to awards that may be granted in the future to eligible participants under the 2020 LTIP, as amended, because the grant of awards and the terms of such awards are to be determined in the sole discretion of the Compensation Committee at the time of grant. All of our employees, including the NEOs, are potential recipients of awards under the 2020 LTIP, as amended. The closing price of a share of our common stock on the NYSE on the record date was $7.01 per share. Vote Required The approval of the LTIP Amendment requires the affirmative vote of a majority of votes cast affirmatively or negatively. For this proposal, abstentions and broker non-votes will not be considered “votes cast” and will have no effect on the vote. If you own your shares through a broker, you must give the broker instructions to vote your shares with respect to the LTIP Amendment if you wish for your shares to be voted. However, if you submit a proxy card, any proposals for which you do not provide instructions will be voted in accordance with the Board’s recommendation. Board Recommendation The Board recommends that shareholders vote “FOR” the approval of an amendment to the VAALCO Energy, Inc. 2020 Long Term Incentive Plan to increase the number of shares reserved for issuance pursuant to awards. 84 2024 Proxy Statement Other Matters Delinquent Section 16(a) Reports Section 16(a) of the Our bylaws provide that Pursuant to Rule 14a-19 under the Exchange Act, we are required to include on our proxy card all nominees for director for whom we have received notice under the Rule 14a-19, which must be received no later than 60 calendar days prior to the anniversary of the Annual Meeting. For any such director nominee to be included on our proxy card for next year’s annual meeting, notice must be received no later than April 7, 2025. Please note that the notice requirement under Rule 14a-19 is in addition to the applicable notice requirements under the advance notice provisions of our bylaws described above. 85 VAALCO Energy, Inc. Contact Information Shareholder proposals or nominations and other requests for information should be sent to: VAALCO Energy, Inc. 9800 Richmond Avenue, Suite 700 Houston, Texas 77042 Attention: Corporate Secretary Special Note Regarding Forward-Looking Statements This Proxy Statement includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are intended to be covered by the safe harbors created by those laws. Where a forward-looking statement expresses or implies an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. All statements other than statements of historical fact may be forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “forecast,” “outlook,” “aim,” “target,” “will,” “could,” “should,” “may,” “likely,” “plan” and “probably” or similar words may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this press release include, but are not limited to, statements relating to (i) estimates of future drilling, production, sales and costs of acquiring crude oil, natural gas and natural gas liquids; (ii) the proposed acquisition of Svenska and its terms, timing and closing, including receipt of required regulatory approvals and satisfaction of other closing conditions; (iii) expectations regarding future exploration and the development, growth and potential of VAALCO’s operations, project pipeline and investments, and schedule and anticipated benefits to be derived therefrom; (iv) expectations regarding future acquisitions, investments or divestitures; (v) expectations of future dividends and other potential returns to shareholders; (vi) expectations of future balance sheet strength; and (vii) expectations regarding VAALCO’s ability to effectively integrate assets and properties it may acquire as a result of the acquisition of Svenska into its operations and the benefits of acquiring Svenska. Such forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to: the ability to obtain regulatory approvals in connection with the proposed acquisition of Svenska; the amount of any pre-closing dividends permitted by the law applicable to Svenska; the ability to complete the proposed acquisition on the anticipated terms and timetable; the possibility that various closing conditions for the acquisition of Svenska may not be satisfied or waived; risks relating to any unforeseen liabilities of the Svenska; the outcome of any cost audits undertaken by the Cote d’Ivoire government; timing and amounts of any decommissioning or other wind up costs relating to any acquired Nigerian assets; declines in oil or natural gas prices; the level of success in exploration, development and production activities; actions of joint-venture partners risks relating to any unforeseen liabilities of VAALCO; the ability to generate cash flows that, along with cash on hand, will be sufficient to support operations and cash requirements; the impact and costs of compliance with laws and regulations governing oil and gas operations; the risks described under the caption “Risk Factors” in VAALCO’s filings with the SEC, including its most recent Annual Report on Form 10-K filed with the SEC. Dividends beyond the first quarter of 2024 have not yet been approved or declared by the Board. The declaration and payment of future dividends and the terms of share buybacks remains at the discretion of the Board and will be determined based on VAALCO’s financial results, balance sheet strength, cash and liquidity requirements, future prospects, crude oil and natural gas prices, and other factors deemed relevant by the Board. The Board reserves all powers related to the declaration and payment of dividends and the terms of share buybacks. Consequently, in determining the dividend to be declared and paid on VAALCO common stock or the terms of share buybacks, the Board may revise or terminate the payment level or buyback terms at any time without prior notice. 86 2024 Proxy Statement Other Matters We know of no other business to be transacted, but if any other matters do come before the meeting, the persons named as proxies in the accompanying proxy, or their substitutes, will vote or act with respect to them in accordance with their best judgment. By Order of the Board of Directors, Andrew L. Fawthrop Chair of the Board Houston, Texas April 26, 2024 87 VAALCO Energy, Inc. Appendix A-1 Vaalco Energy, Inc. 2020 Long Term Incentive Plan The VAALCO Energy, Inc. 2020 Long Term Incentive Plan (the “Plan”) was adopted by the Board of Directors of VAALCO Energy, Inc., a Delaware corporation (the “Company”), effective as of April 27, 2020 (the “Effective Date”), subject to approval by the Company’s stockholders. Article 1. Purpose The purpose of the Plan is to attract and retain the services of key Employees, key Contractors, and Outside Directors of the Company and its Subsidiaries and to provide such persons with a proprietary interest in the Company through the granting of Incentive Stock Options, Nonqualified Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, Performance Awards, Dividend Equivalent Rights, and Other Awards, whether granted singly, or in combination, or in tandem, that will: With respect to Reporting Participants, the Plan and all transactions under the Plan are intended to comply with all applicable conditions of Rule 16b-3 promulgated under the Exchange Act. To the extent any provision of the Plan or action by the Committee fails to so comply, such provision or action shall be deemed null and void ab initio, to the extent permitted by law and deemed advisable by the Committee. Article 2. Definitions For the purpose of the Plan, unless the context requires otherwise, the following terms shall have the meanings indicated: 2.1 “Applicable Law” means all legal requirements relating to the administration of equity incentive plans and the issuance and distribution of shares of Common Stock, if any, under applicable corporate laws, applicable securities laws, the rules of any exchange or inter-dealer quotation system upon which the Company’s securities are listed or quoted, the rules of any foreign jurisdiction applicable to Incentives granted to residents therein, and any other applicable law, rule or restriction. 2.3 “Award” means the grant of any Incentive Stock Option, Nonqualified Stock Option, Restricted Stock, SAR, Restricted Stock Unit, Performance Award, Dividend Equivalent Right or Other Award, whether granted singly or in combination or in tandem (each individually referred to herein as an “Incentive”). 2.4 “Award Agreement” means a written agreement between a Participant and the Company which sets out the terms of the grant of an Award. 2.5 “Award Period” means the period set forth in the Award Agreement during which one or more Incentives granted under an Award may be exercised. 88 2024 Proxy Statement Notwithstanding the foregoing provisions of this Section 2.7, to the extent that any payment (or acceleration of payment) hereunder is considered to be deferred compensation that is subject to, and not exempt under, Section 409A of the Code, then the term Change in Control hereunder shall be construed to have the meaning as set forth in Section 409A of the Code with respect to the payment (or acceleration of payment) of such deferred compensation, but only to the extent inconsistent with the foregoing provisions of the Change in Control definition (above) as determined by the Incumbent Board. 2.8 “Claim” means any claim, liability or obligation of any nature, arising out of or relating to this Plan or an alleged breach of this Plan or an Award Agreement. 89 VAALCO Energy, Inc. 2.10 “Committee” means the committee appointed or designated by the Board to administer the Plan in accordance with Article 3 of this Plan. 2.11 “Common Stock” means the common stock, par value $0.10 per share, which the Company is currently authorized to issue or may in the future be authorized to issue, or any securities into which or for which the common stock of the Company may be converted or exchanged, as the case may be, pursuant to the terms of this Plan. 2.13 “Contractor” means any natural person, who is not an Employee, rendering bona fide services to the Company or a Subsidiary, with compensation, pursuant to a written independent contractor agreement between such person and the Company or a Subsidiary, provided that such services are not rendered in connection with the offer or sale of securities in a capital raising transaction and do not directly or indirectly promote or maintain a market for the Company’s securities. 2.14 “Corporation” means any entity that (a) is defined as a corporation under Section 7701 of the Code and (b) is the Company or is in an unbroken chain of corporations (other than the Company) beginning with the Company, if each of the corporations other than the last corporation in the unbroken chain owns stock possessing a majority of the total combined voting power of all classes of stock in one of the other corporations in the chain. For purposes of clause (b) hereof, an entity shall be treated as a “corporation” if it satisfies the definition of a corporation under Section 7701 of the Code. 2.15 “Date of Grant” means the effective date on which an Award is made to a Participant as set forth in the applicable Award Agreement; provided, however, that solely for purposes of Section 16 of the Exchange Act and the rules and regulations promulgated thereunder, the Date of Grant of an Award shall be the date of stockholder approval of the Plan if such date is later than the effective date of such Award as set forth in the Award Agreement. 2.16 “Dividend Equivalent Right” means the right of the holder thereof to receive credits based on the cash dividends that would have been paid on the shares of Common Stock specified in the Award if such shares were held by the Participant to whom the Award is made. 2.17 “Employee” means a common law employee (as defined in accordance with the Regulations and Revenue Rulings then applicable under Section 3401(c) of the Code) of the Company or any Subsidiary of the Company; provided, however, in the case of individuals whose employment status, by virtue of their employer or residence, is not determined under Section 3401(c) of the Code, “Employee” shall mean an individual treated as an employee for local payroll tax or employment purposes by the applicable employer under Applicable Law for the relevant period. 2.20 “Exempt Shares” means shares of Common Stock subject to an Award that has been granted with (or that has been amended by the Committee to include) more favorable vesting provisions than those set forth in Section 7.2. No more than five percent (5%) of the shares of Common Stock that may be delivered pursuant to Awards may be shares designated as “Exempt Shares.” 90 2024 Proxy Statement 2.23 “Fair Market Value” means, as of a particular date, (a) if the shares of Common Stock are listed on any established national securities exchange, the closing sales price per share of Common Stock on the consolidated transaction reporting system for the principal securities exchange for the Common Stock on that date (as determined by the Committee, in its discretion), or, if there shall have been no such sale so reported on that date, on the last preceding date on which such a sale was so reported; (b) if the shares of Common Stock are not so listed, but are quoted on an automated quotation system, the closing sales price per share of Common Stock reported on the automated quotation system on that date, or, if there shall have been no such sale so reported on that date, on the last preceding date on which such a sale was so reported; (c) if the Common Stock is not so listed or quoted, the mean between the closing bid and asked price on that date, or, if there are no quotations available for such date, on the last preceding date on which such quotations shall be available, as reported by the National Association of Securities Dealer, Inc.’s OTC Bulletin Board or the Pink OTC Markets, Inc. (previously known as the National Quotation Bureau, Inc.); or (d) if none of the above is applicable, such amount as may be determined by the Committee (acting on the advice of an Independent Third Party, should the Committee elect in its sole discretion to utilize an Independent Third Party for this purpose), in good faith, to be the fair market value per share of Common Stock. The determination of Fair Market Value shall, where applicable, be in compliance with Section 409A of the Code. 2.24 “Full Value Awards” means any Award with a net benefit to the Participant, without regard to any restrictions such as those described in Section 6.4(b), equal to the aggregate Fair Market Value of the total shares of Common Stock subject to the Award. Full Value Awards include Restricted Stock and Restricted Stock Units, but do not include Stock Options and SARs. 2.27 “Incentive Stock Option” means an incentive stock option within the meaning of Section 422 of the Code, granted pursuant to this Plan. 2.28 “Independent Third Party” means an individual or entity independent of the Company having experience in providing investment banking or similar appraisal or valuation services and with expertise generally in the valuation of securities or other property for purposes of this Plan. The Committee may utilize one or more Independent Third Parties. 2.29 “Nonqualified Stock Option” means a nonqualified stock option, granted pursuant to this Plan, which is not an Incentive Stock Option. 2.30 “Option Price” means the price which must be paid by a Participant upon exercise of a Stock Option to purchase a share of Common Stock. 2.34 “Performance Award” means an Award hereunder of cash, shares of Common Stock, units or rights based upon, payable in, or otherwise related to, Common Stock pursuant to Section 6.7 hereof. 2.37 “Prior Plan Awards” means (a) any awards under the Prior Plans that are outstanding on the Effective Date, and that on or after the Effective Date, are forfeited, expire or are canceled; and (b) any shares subject to awards relating to Common Stock under the Prior Plans that, on or after the Effective Date are settled in cash. 91 VAALCO Energy, Inc. 2.38 “Prior Plans” means the VAALCO Energy, Inc. 2014 Long Term Incentive Plan. 2.39 “Reporting Participant” means a Participant who is subject to the reporting requirements of Section 16 of the Exchange Act. 2.40 “Restricted Stock” means shares of Common Stock issued or transferred to a Participant pursuant to Section 6.4 of this Plan which are subject to restrictions or limitations set forth in this Plan and in the related Award Agreement. 2.41 “Restricted Stock Units” means units awarded to Participants pursuant to Section 6.6 hereof, which are convertible into Common Stock and/or cash at such time as such units are no longer subject to restrictions as established by the Committee. 2.42 “Restriction Period” is defined in Section 6.4(b)(i) hereof. 2.43 “Retirement” shall have the meaning set forth in the Participant’s Award Agreement; provided that, if such Award Agreement does not define such term, Retirement shall mean the Participant’s voluntary Termination of Service for age on or after the date such Participant attains the normal retirement age of sixty-five (65) years. 2.44 “SAR” or “Stock Appreciation Right” means the right to receive an amount, in cash and/or Common Stock, equal to the excess of the Fair Market Value of a specified number of shares of Common Stock as of the date the SAR is exercised (or, as provided in the Award Agreement, converted) over the SAR Price for such shares. 2.45 “SAR Price” means the exercise price or conversion price of each share of Common Stock covered by a SAR, determined on the Date of Grant of the SAR. 2.46 “Spread” is defined in Section 12.4(b) hereof. 2.47 “Stock Option” means a Nonqualified Stock Option or an Incentive Stock Option. 2.48 “Subsidiary” means (a) any corporation in an unbroken chain of corporations beginning with the Company, if each of the corporations other than the last corporation in the unbroken chain owns stock possessing a majority of the total combined voting power of all classes of stock in one of the other corporations in the chain, (b) any limited partnership, if the Company or any corporation described in item (a) above owns a majority of the general partnership interest and a majority of the limited partnership interests entitled to vote on the removal and replacement of the general partner, and (c) any partnership or limited liability company, if the partners or members thereof are composed only of the Company, any corporation listed in item (a) above or any limited partnership listed in item (b) above. “Subsidiaries” means more than one of any such corporations, limited partnerships, partnerships or limited liability companies. 2.49 “Tenure Award” means an Award that vests over time based upon the Participant’s continued employment with or service to the Company or its Subsidiaries. 92 2024 Proxy Statement 2.50 “Termination of Service” occurs when a Participant who is (a) an Employee of the Company or any Subsidiary ceases to serve as an Employee of the Company and its Subsidiaries, for any reason; (b) an Outside Director of the Company or a Subsidiary ceases to serve as a director of the Company and its Subsidiaries for any reason; or (c) a Contractor of the Company or a Subsidiary ceases to serve as a Contractor of the Company and its Subsidiaries for any reason. Except as may be necessary or desirable to comply with applicable federal or state law or to the extent otherwise provided in a Participant’s Award Agreement, a “Termination of Service” shall not be deemed to have occurred when a Participant who is an Employee becomes an Outside Director or Contractor or vice versa. If, however, a Participant who is an Employee and who has an Incentive Stock Option ceases to be an Employee but does not suffer a Termination of Service, and if that Participant does not exercise the Incentive Stock Option within the time required under Section 422 of the Code upon ceasing to be an Employee, the Incentive Stock Option shall thereafter become a Nonqualified Stock Option. Notwithstanding the foregoing provisions of this Section 2.50, in the event an Award issued under the Plan is subject to Section 409A of the Code, then, in lieu of the foregoing definition and to the extent necessary to comply with the requirements of Section 409A of the Code, the definition of “Termination of Service” for purposes of such Award shall be the definition of “separation from service” provided for under Section 409A of the Code and the regulations or other guidance issued thereunder. 2.51 “Total and Permanent Disability” means a Participant is qualified for long-term disability benefits under the Company’s or Subsidiary’s disability plan or insurance policy; or, if no such plan or policy is then in existence or if the Participant is not eligible to participate in such plan or policy, that the Participant, because of a physical or mental condition resulting from bodily injury, disease, or mental disorder, is unable to perform his or her duties of employment for a period of six (6) continuous months, as determined in good faith by the Committee, based upon medical reports or other evidence satisfactory to the Committee; provided that, with respect to any Incentive Stock Option, Total and Permanent Disability shall have the meaning given it under the rules governing Incentive Stock Options under the Code. Notwithstanding the foregoing provisions of this Section 2.51, in the event an Award issued under the Plan is subject to Section 409A of the Code, then, in lieu of the foregoing definition and to the extent necessary to comply with the requirements of Section 409A of the Code, the definition of “Total and Permanent Disability” for purposes of such Award shall be the definition of “disability” provided for under Section 409A of the Code and the regulations or other guidance issued thereunder. Article 3. Administration 3.1 General Administration; Establishment of Committee. Subject to the terms of this Article 3, the Plan shall be administered by the Board or such committee of the Board as is designated by the Board to administer the Plan (the “Committee”). The Committee shall consist of not fewer than two persons. Any member of the Committee may be removed at any time, with or without cause, by resolution of the Board. Any vacancy occurring in the membership of the Committee may be filled by appointment by the Board. At any time there is no Committee to administer the Plan, any references in this Plan to the Committee shall be deemed to refer to the Board. Membership on the Committee shall be limited to those members of the Board who are “non-employee directors” as defined in Rule 16b-3 promulgated under the Exchange Act. The Committee shall select one of its members to act as its Chairman. A majority of the Committee shall constitute a quorum, and the act of a majority of the members of the Committee present at a meeting at which a quorum is present shall be the act of the Committee. 93 VAALCO Energy, Inc. 3.3 Authority of the Committee. The Committee, in its discretion, shall (a) interpret the Plan and Award Agreements, (b) prescribe, amend, and rescind any rules and regulations and sub-plans (including sub-plans for Awards made to Participants who are not resident in the United States), as necessary or appropriate for the administration of the Plan, (c) establish performance goals for an Award and certify the extent of their achievement, and (d) make such other determinations or certifications and take such other action as it deems necessary or advisable in the administration of the Plan. Any interpretation, determination, or other action made or taken by the Committee shall be final, binding, and conclusive on all interested parties. The Committee’s discretion set forth herein shall not be limited by any provision of the Plan, including any provision which by its terms is applicable notwithstanding any other provision of the Plan to the contrary. Except as set forth in Section 3.2(b) above, the Committee may delegate to officers of the Company, pursuant to a written delegation, the authority to perform specified functions under the Plan. Any actions taken by any officers of the Company pursuant to such written delegation of authority shall be deemed to have been taken by the Committee. With respect to restrictions in the Plan that are based on the requirements of Rule 16b 3 promulgated under the Exchange Act, Section 422 of the Code, the rules of any exchange or inter-dealer quotation system upon which the Company’s securities are listed or quoted, or any other Applicable Law, to the extent that any such restrictions are no longer required by Applicable Law, the Committee shall have the sole discretion and authority to grant Awards that are not subject to such mandated restrictions and/or to waive any such mandated restrictions with respect to outstanding Awards. 94 2024 Proxy Statement Article 4. Eligibility Any Employee (including an Employee who is also a director or an officer), Contractor or Outside Director of the Company whose judgment, initiative, and efforts contributed or may be expected to contribute to the successful performance of the Company is eligible to participate in the Plan; provided that only Employees of a Corporation shall be eligible to receive Incentive Stock Options. The Committee, upon its own action, may grant, but shall not be required to grant, an Award to any Employee, Contractor or Outside Director. Awards may be granted by the Committee at any time and from time to time to new Participants, or to then Participants, or to a greater or lesser number of Participants, and may include or exclude previous Participants, as the Committee shall determine. Except as required by this Plan, Awards need not contain similar provisions. The Committee’s determinations under the Plan (including without limitation determinations of which Employees, Contractors or Outside Directors, if any, are to receive Awards, the form, amount and timing of such Awards, the terms and provisions of such Awards and the agreements evidencing same) need not be uniform and may be made by it selectively among Participants who receive, or are eligible to receive, Awards under the Plan. Article 5. Shares Subject To Plan 5.1 Number Available for Awards. Subject to adjustment as provided in Articles 11 and 12, the maximum number of shares of Common Stock that may be delivered pursuant to Awards granted under the Plan is five million five hundred thousand (5,500,000) shares plus any Prior Plan Awards, of which up to one million (1,000,000) shares may be delivered pursuant to Incentive Stock Options. Shares to be issued may be made available from authorized but unissued Common Stock, Common Stock held by the Company in its treasury, or Common Stock purchased by the Company on the open market or otherwise. During the term of this Plan, the Company will at all times reserve and keep available the number of shares of Common Stock that shall be sufficient to satisfy the requirements of this Plan. 5.2 Share Limits. Subject to adjustment pursuant to Articles 11 and 12, (a) the maximum number of shares of Common Stock that may be granted (in the case of Stock Options and SARs) or that may vest (in the case of Full Value Awards) with respect to a Participant during any calendar year is two million (2,000,000) shares of Common Stock, and (b) the maximum aggregate cash payout (with respect to any Incentive paid out in cash) which may be paid to a Participant during any calendar year is ten million dollars ($10,000,000). 5.3 Reuse of Shares. To the extent that any Award under this Plan shall be forfeited, shall expire or be canceled, in whole or in part, then the number of shares of Common Stock covered by the Award or stock option so forfeited, expired or canceled shall again be available for awards under Section 5.1 of this Plan. Awards that may be satisfied either by the issuance of shares of Common Stock or by cash or other consideration shall be counted against the maximum number of shares of Common Stock that may be issued under this Plan only during the period that the Award is outstanding or to the extent the Award is ultimately satisfied by the issuance of shares of Common Stock. Shares of Common Stock otherwise deliverable pursuant to an Award that are withheld upon exercise or vesting of an Award for purposes of paying the exercise price or tax withholdings shall be treated as delivered to the Participant and shall be counted against the maximum number of shares of Common Stock that may be issued under this Plan. Awards will not reduce the number of shares of Common Stock that may be issued pursuant to this Plan if the settlement of the Award will not require the issuance of shares of Common Stock, as, for example, a SAR that can be satisfied only by the payment of cash. Notwithstanding any provisions of the Plan to the contrary, only shares forfeited back to the Company, shares canceled on account of termination, expiration or lapse of an Award, shall again be available for grant of Incentive Stock Options under the Plan, but shall not increase the maximum number of shares described in Section 5.1 above as the maximum number of shares of Common Stock that may be delivered pursuant to Incentive Stock Options. 95 VAALCO Energy, Inc. 5.4 Fungible Share Provision. The aggregate number of shares of Common Stock available for issuance under the Plan shall be reduced by 2.0 shares for each share delivered in settlement of Awards that are Full Value Awards and one share for each share delivered in settlement of Awards that are not Full Value Awards. Any shares of Common Stock that again become available for issuance under the Plan pursuant to Section 5.2 shall be added back to the Plan as 2.0 shares if such shares were subject to Awards that are Full Value Awards and one share if such shares were subject to Awards that are not Full Value Awards. 5.5 Limitation on Outside Director Awards. No Outside Director may be granted any Award or Awards denominated in shares that exceed in the aggregate $500,000 in Fair Market Value (such Fair Market Value computed as of the Date of Grant) in any calendar year period, plus an additional $500,000 in Fair Market Value (determined as of the Date of Grant) for one-time awards to a newly appointed or elected Outside Director. The foregoing limit shall not apply to any Award made pursuant to deferred compensation arrangements in lieu of all or a portion of cash retainers. Article 6. Grant Of Awards 6.1 In General. 6.2 Option Price. The Option Price for any share of Common Stock which may be purchased under a Nonqualified Stock Option for any share of Common Stock must be equal to or greater than the Fair Market Value of the share on the Date of Grant. The Option Price for any share of Common Stock which may be purchased under an Incentive Stock Option must be at least equal to the Fair Market Value of the share on the Date of Grant; if an Incentive Stock Option is granted to an Employee who owns or is deemed to own (by reason of the attribution rules of Section 424(d) of the Code) more than ten percent (10%) of the combined voting power of all classes of stock of the Company (or any parent or Subsidiary), the Option Price shall be at least one hundred ten percent (110%) of the Fair Market Value of the Common Stock on the Date of Grant. No dividends or Dividend Equivalent Rights may be paid or granted with respect to any Stock Option granted hereunder. 96 2024 Proxy Statement 6.3 Maximum ISO Grants. The Committee may not grant Incentive Stock Options under the Plan to any Employee which would permit the aggregate Fair Market Value (determined on the Date of Grant) of the Common Stock with respect to which Incentive Stock Options (under this and any other plan of the Company and its Subsidiaries) are exercisable for the first time by such Employee during any calendar year to exceed $100,000. To the extent any Stock Option granted under this Plan which is designated as an Incentive Stock Option exceeds this limit or otherwise fails to qualify as an Incentive Stock Option, such Stock Option (or any such portion thereof) shall be a Nonqualified Stock Option. In such case, the Committee shall designate which stock will be treated as Incentive Stock Option stock by causing the issuance of a separate stock certificate and identifying such stock as Incentive Stock Option stock on the Company’s stock transfer records. 6.4 Restricted Stock. If Restricted Stock is granted to or received by a Participant under an Award (including a Stock Option), the Committee shall set forth in the related Award Agreement: (a) the number of shares of Common Stock awarded, (b) the price, if any, to be paid by the Participant for such Restricted Stock and the method of payment of the price, (c) the time or times within which such Award may be subject to forfeiture, (d) specified Performance Goals of the Company, a Subsidiary, any division thereof or any group of Employees of the Company, or other criteria, which the Committee determines must be met in order to remove any restrictions (including vesting) on such Award, and (e) all other terms, limitations, restrictions, and conditions of the Restricted Stock, which shall be consistent with this Plan, to the extent applicable and, to the extent Restricted Stock granted under the Plan is subject to Section 409A of the Code, in compliance with the applicable requirements of Section 409A of the Code and the regulations or other guidance issued thereunder. The provisions of Restricted Stock need not be the same with respect to each Participant. 97 VAALCO Energy, Inc. 6.5 SARs. The Committee may grant SARs to any Participant, either as a separate Award or in connection with a Stock Option. SARs shall be subject to such terms and conditions as the Committee shall impose, provided that such terms and conditions are (a) not inconsistent with the Plan, and (b) to the extent a SAR issued under the Plan is subject to Section 409A of the Code, in compliance with the applicable requirements of Section 409A of the Code and the regulations or other guidance issued thereunder. The grant of the SAR may provide that the holder may be paid for the value of the SAR either in cash or in shares of Common Stock, or a combination thereof. In the event of the exercise of a SAR payable in shares of Common Stock, the holder of the SAR shall receive that number of whole shares of Common Stock having an aggregate Fair Market Value on the date of exercise equal to the value obtained by multiplying (a) the difference between the Fair Market Value of a share of Common Stock on the date of exercise over the SAR Price as set forth in such SAR (or other value specified in the agreement granting the SAR), by (b) the number of shares of Common Stock as to which the SAR is exercised, with a cash settlement to be made for any fractional shares of Common Stock. The SAR Price for any share of Common Stock subject to a SAR may be equal to or greater than the Fair Market Value of the share on the Date of Grant. The Committee, in its sole discretion, may place a ceiling on the amount payable upon exercise of a SAR, but any such limitation shall be specified at the time that the SAR is granted. No dividends or Dividend Equivalent Rights may be paid or granted with respect to any SAR granted hereunder. 6.6 Restricted Stock Units. Restricted Stock Units may be awarded or sold to any Participant under such terms and conditions as shall be established by the Committee, provided, however, that such terms and conditions are (a) not inconsistent with the Plan, and (b) to the extent a Restricted Stock Unit issued under the Plan is subject to Section 409A of the Code, in compliance with the applicable requirements of Section 409A of the Code and the regulations or other guidance issued thereunder. Restricted Stock Units shall be subject to such restrictions as the Committee determines, including, without limitation, (a) a prohibition against sale, assignment, transfer, pledge, hypothecation or other encumbrance for a specified period; or (b) a requirement that the holder forfeit (or in the case of shares of Common Stock or units sold to the Participant, resell to the Company at cost) such shares or units in the event of Termination of Service during the period of restriction. 98 2024 Proxy Statement 6.7 Performance Awards. 6.8 Dividend Equivalent Rights. The Committee may grant a Dividend Equivalent Right to any Participant, either as a component of another Award or as a separate Award. The terms and conditions of the Dividend Equivalent Right shall be specified by the grant. Dividend equivalents credited to the holder of a Dividend Equivalent Right may be paid currently or may be deemed to be reinvested in additional shares of Common Stock (which may thereafter accrue additional dividend equivalents). Any such reinvestment shall be at the Fair Market Value at the time thereof. Dividend Equivalent Rights may be settled in cash or shares of Common Stock, or a combination thereof, in a single payment or in installments. A Dividend Equivalent Right granted as a component of another Award may provide that such Dividend Equivalent Right shall be settled upon exercise, settlement, or payment of, or lapse of restrictions on, such other Award, and that such Dividend Equivalent Right granted as a component of another Award may also contain terms and conditions different from such other Award; provided that (a) any Dividend Equivalent Rights with respect to such Award shall be withheld by the Company for the Participant’s account until such Award is vested, subject to such terms as determined by the Committee; and (b) such Dividend Equivalent Rights so withheld by the Company and attributable to any particular Award shall be distributed to such Participant in cash or, at the discretion of the Committee, in shares of Common Stock having a Fair Market Value equal to the amount of such Dividend Equivalent Rights, if applicable, upon vesting of the Award and if such Award is forfeited, the Participant shall have no right to such Dividend Equivalent Rights. No Dividend Equivalent Rights may be paid or granted with respect to any Stock Option or SAR. 99 VAALCO Energy, Inc. 6.9 Other Awards. The Committee may grant to any Participant other forms of Awards, based upon, payable in, or otherwise related to, in whole or in part, shares of Common Stock, if the Committee determines that such other form of Award is consistent with the purpose and restrictions of this Plan. The terms and conditions of such other form of Award shall be specified by the grant. Such Other Awards may be granted for no cash consideration, for such minimum consideration as may be required by Applicable Law, or for such other consideration as may be specified by the grant. 6.10 Performance Goals. Awards of Restricted Stock, Restricted Stock Units, Performance Award and Other Awards (whether relating to cash or shares of Common Stock) under the Plan may be made subject to the attainment of Performance Goals established by the Committee, which may include, but are not limited to, one or more or any combination of the following business criteria: cash flow (including, but not limited to, operating cash flow; free cash flow or cash flow return on capital or investments); cost; revenues; sales; ratio of debt to debt plus equity; net borrowing, credit quality or debt ratings; profit (including, but not limited to, gross profit; profit growth; net operating profit; profit before tax; economic profit; net profit or profit margins); profit-related return ratios; earnings or income (including, but not limited to, earnings or income before or after taxes; earnings or income before interest and taxes; earnings or income before interest, taxes, depreciation and amortization, earnings or income per share (whether on a pre-tax, after-tax, operational or other basis); or operating earnings or income); gross margin; capital expenditures; expenses or expense levels; expense targets (including, without limitation, reserve replacement costs and finding and development costs); economic value added; ratio of operating earnings to capital spending or any other operating ratios; sales (including, but not limited to, net sales; sales growth; or net sales growth (measured either in dollars, volumes of hydrocarbon production, or other objective and specific criteria as designated by the Committee); productivity ratios; growth measures; turnover of assets, capital, or inventory (including, without limitation, reserve additions or revisions, and economic value added from reserves); margins; measures of health, safety or environment; operating efficiency (including, without limitation, project completion time, budget goals, operational downtime, rig utilization, and similar matters); customer service or satisfaction; debt ratios (e.g., debt to equity and debt to total capital); working capital targets; net asset value per share; the accomplishment of mergers, acquisitions, dispositions, public offerings or similar extraordinary business transactions; price of the Company’s Common Stock; return measures (including, but not limited to, return on assets, capital, equity, investment or sales); equity or stockholders’ equity; market share; inventory levels, inventory turn or shrinkage; or total return to stockholders (“Performance Criteria”). Any Performance Criteria may be used to measure the performance of the Company as a whole or any business unit of the Company and may be measured relative to a peer group or index. Any Performance Criteria may include or exclude (a) events that are of an unusual nature or indicate infrequency of occurrence, (b) gains or losses on the disposition of a business, (c) changes in tax or accounting regulations or laws, (d) the effect of a merger or acquisition, as identified in the Company’s quarterly and annual earnings releases, or (e) other similar occurrences. In all other respects, Performance Criteria shall be calculated in accordance with the Company’s financial statements, under generally accepted accounting principles, or under a methodology established by the Committee prior to the issuance of an Award which is consistently applied and identified in the audited financial statements, including footnotes, or the Compensation Discussion and Analysis section of the Company’s annual report. 6.11 Tandem Awards. The Committee may grant two or more Incentives in one Award in the form of a “tandem Award,” so that the right of the Participant to exercise one Incentive shall be canceled if, and to the extent, the other Incentive is exercised. For example, if a Stock Option and a SAR are issued in a tandem Award, and the Participant exercises the SAR with respect to one hundred (100) shares of Common Stock, the right of the Participant to exercise the related Stock Option shall be canceled to the extent of one hundred (100) shares of Common Stock. 100 2024 Proxy Statement 6.12 No Repricing of Stock Options or SARs. The Committee may not “reprice” any Stock Option or SAR. For purposes of this Section 6.12, “reprice” means any of the following or any other action that has the same effect: (a) amending a Stock Option or SAR to reduce its exercise price or base price, (b) canceling a Stock Option or SAR at a time when its exercise price or base price exceeds the Fair Market Value of a share of Common Stock in exchange for cash or a Stock Option, SAR, award of Restricted Stock or other equity award, or (c) taking any other action that is treated as a repricing under generally accepted accounting principles, provided that nothing in this Section 6.12 shall prevent the Committee from making adjustments pursuant to Article 11, from exchanging or cancelling Incentives pursuant to Article 12, or substituting Incentives in accordance with Article 14. 6.13 Recoupment for Restatements. Notwithstanding any other language in this Plan to the contrary, the Company may recoup all or any portion of any shares or cash paid to a Participant in connection with an Award, in the event of a restatement of the Company’s financial statements as set forth in the Company’s clawback policy, if any, approved by the Company’s Board from time to time. Article 7. Award Period; Vesting 7.1 Award Period. Subject to the other provisions of this Plan, the Committee may, in its discretion, provide that an Incentive may not be exercised in whole or in part for any period or periods of time or beyond any date specified in the Award Agreement. Except as provided in the Award Agreement, an Incentive may be exercised in whole or in part at any time during its term. The Award Period for an Incentive shall be reduced or terminated upon Termination of Service, except as otherwise may be provided in the Award Agreement. No Incentive granted under the Plan may be exercised at any time after the end of its Award Period. No portion of any Incentive may be exercised after the expiration of ten (10) years from its Date of Grant. However, if an Employee owns or is deemed to own (by reason of the attribution rules of Section 424(d) of the Code) more than ten percent (10%) of the combined voting power of all classes of stock of the Company (or any parent or Subsidiary) and an Incentive Stock Option is granted to such Employee, the term of such Incentive Stock Option (to the extent required by the Code at the time of grant) shall be no more than five (5) years from the Date of Grant. 7.2 Vesting. The Committee, in its sole discretion, shall establish the vesting terms applicable to an Incentive, provided that any such vesting terms shall not be inconsistent with the terms of the Plan, including, without limitation, this Section 7.2. Except as otherwise provided herein, no Incentive (nor any portion of an Incentive, even on a pro rata basis) may vest earlier than one (1) year after the Date of Grant; provided, however, with respect to grants of Awards made on the date of an Annual Stockholders Meeting to Outside Directors, such one (1) year vesting period shall be deemed satisfied if such Awards vest on the earlier of the first anniversary of the Date of Grant or the first Annual Stockholders Meeting following the Date of Grant (but not less than fifty (50) weeks following the Date of Grant). Except as otherwise provided herein, the Committee may not accelerate the date on which all or any portion of an Award may be vested or waive the Restriction Period on a Full Value Award except upon (a) the Participant’s death or Total and Permanent Disability; (b) Retirement; or (c) upon a Change in Control. Notwithstanding the foregoing, the Committee may, in its sole discretion, grant Awards with more favorable vesting provisions than set forth in this Section 7.2, provided that the shares of Common Stock subject to such Awards shall be Exempt Shares. 101 VAALCO Energy, Inc. Article 8. Exercise Or Conversion Of Incentive 8.1 In General. A vested Incentive may be exercised or converted, during its Award Period, subject to limitations and restrictions set forth in the Award Agreement. 8.2 Securities Law and Exchange Restrictions. In no event may an Incentive be exercised or shares of Common Stock issued pursuant to an Award if a necessary listing or quotation of the shares of Common Stock on a stock exchange or inter-dealer quotation system or any registration under state or federal securities laws required under the circumstances has not been accomplished. 8.3 Exercise of Stock Option. 102 2024 Proxy Statement 8.4 SARs. Subject to the conditions of this Section 8.4 and such administrative regulations as the Committee may from time to time adopt, a SAR may be exercised by the delivery (including by FAX) of written notice to the Committee setting forth the number of shares of Common Stock with respect to which the SAR is to be exercised and the date of exercise thereof (the “Exercise Date”) which shall be at least three (3) days after giving such notice unless an earlier time shall have been mutually agreed upon. Subject to the terms of the Award Agreement and only if permissible under Section 409A of the Code and the regulations or other guidance issued thereunder (or, if not so permissible, at such time as permitted by Section 409A of the Code and the regulations or other guidance issued thereunder), the Participant shall receive from the Company in exchange therefor in the discretion of the Committee, and subject to the terms of the Award Agreement: The distribution of any cash or Common Stock pursuant to the foregoing sentence shall be made at such time as set forth in the Award Agreement. 8.5 Disqualifying Disposition of Incentive Stock Option. If shares of Common Stock acquired upon exercise of an Incentive Stock Option are disposed of by a Participant prior to the expiration of either two (2) years from the Date of Grant of such Stock Option or one (1) year from the transfer of shares of Common Stock to the Participant pursuant to the exercise of such Stock Option, or in any other disqualifying disposition within the meaning of Section 422 of the Code, such Participant shall notify the Company in writing of the date and terms of such disposition. A disqualifying disposition by a Participant shall not affect the status of any other Stock Option granted under the Plan as an Incentive Stock Option within the meaning of Section 422 of the Code. 103 VAALCO Energy, Inc. Article 9. Amendment or Discontinuance Subject to the limitations set forth in this Article 9, the Board may at any time and from time to time, without the consent of the Participants, alter, amend, revise, suspend, or discontinue the Plan in whole or in part; provided, however, that no amendment for which stockholder approval is required either (a) by any securities exchange or inter-dealer quotation system on which the Common Stock is listed or traded or (b) in order for the Plan and Incentives awarded under the Plan to continue to comply with Sections 421 and 422 of the Code, including any successors to such Sections, or other Applicable Law, shall be effective unless such amendment shall be approved by the requisite vote of the stockholders of the Company entitled to vote thereon. Any such amendment shall, to the extent deemed necessary or advisable by the Committee, be applicable to any outstanding Incentives theretofore granted under the Plan, notwithstanding any contrary provisions contained in any Award Agreement. In the event of any such amendment to the Plan, the holder of any Incentive outstanding under the Plan shall, upon request of the Committee and as a condition to the exercisability thereof, execute a conforming amendment in the form prescribed by the Committee to any Award Agreement relating thereto. Notwithstanding anything contained in this Plan to the contrary, unless required by law, no action contemplated or permitted by this Article 9 shall adversely affect any rights of Participants or obligations of the Company to Participants with respect to any Incentive theretofore granted under the Plan without the consent of the affected Participant. Article 10. Term The Plan shall be effective from the date that this Plan is adopted by the Board. Unless sooner terminated by action of the Board, the Plan will terminate on the tenth anniversary of the Effective Date, but Incentives granted before that date will continue to be effective in accordance with their terms and conditions. Article 11. Capital Adjustments In the event that any dividend or other distribution (whether in the form of cash, Common Stock, other securities, or other property), recapitalization, stock split, reverse stock split, rights offering, reorganization, merger, consolidation, split-up, spin-off, split-off, combination, subdivision, repurchase, or exchange of Common Stock or other securities of the Company, issuance of warrants or other rights to purchase Common Stock or other securities of the Company, or other similar corporate transaction or event affects the fair value of an Award, then the Committee shall adjust any or all of the following so that the fair value of the Award immediately after the transaction or event is equal to the fair value of the Award immediately prior to the transaction or event (a) the number of shares and type of Common Stock (or the securities or property) which thereafter may be made the subject of Awards, (b) the number of shares and type of Common Stock (or other securities or property) subject to outstanding Awards, (c)the number of shares and type of Common Stock (or other securities or property) specified as the annual per-participant limitation under Section 5.1 of the Plan, (d) the Option Price of each outstanding Award, (e) the amount, if any, the Company pays for forfeited shares of Common Stock in accordance with Section 6.4, and (f) the number of or SAR Price of shares of Common Stock then subject to outstanding SARs previously granted and unexercised under the Plan, to the end that the same proportion of the Company’s issued and outstanding shares of Common Stock in each instance shall remain subject to exercise at the same aggregate SAR Price; provided, however, that the number of shares of Common Stock (or other securities or property) subject to any Award shall always be a whole number. Notwithstanding the foregoing, no such adjustment shall be made or authorized to the extent that such adjustment would cause the Plan or any Stock Option to violate Section 422 of the Code or Section 409A of the Code. Such adjustments shall be made in accordance with the rules of any securities exchange, stock market, or stock quotation system to which the Company is subject. 104 2024 Proxy Statement Upon the occurrence of any such adjustment, the Company shall provide notice to each affected Participant of its computation of such adjustment which shall be conclusive and shall be binding upon each such Participant. Article 12. Recapitalization, Merger And Consolidation 12.1 No Effect on Company’s Authority. The existence of this Plan and Incentives granted hereunder shall not affect in any way the right or power of the Company or its stockholders to make or authorize any or all adjustments, recapitalizations, reorganizations, or other changes in the Company’s capital structure and its business, or any Change in Control, or any merger or consolidation of the Company, or any issuance of bonds, debentures, preferred or preference stocks ranking prior to or otherwise affecting the Common Stock or the rights thereof (or any rights, options, or warrants to purchase same), or the dissolution or liquidation of the Company, or any sale or transfer of all or any part of its assets or business, or any other corporate act or proceeding, whether of a similar character or otherwise. 12.2 Conversion of Incentives Where Company Survives. Subject to any required action by the stockholders and except as otherwise provided by Section 12.4 hereof or as may be required to comply with Section 409A of the Code and the regulations or other guidance issued thereunder, if the Company shall be the surviving or resulting corporation in any merger, consolidation or share exchange, any Incentive granted hereunder shall pertain to and apply to the securities or rights (including cash, property, or assets) to which a holder of the number of shares of Common Stock subject to the Incentive would have been entitled. 12.3 Exchange or Cancellation of Incentives Where Company Does Not Survive. Except as otherwise provided by Section 12.4 hereof or as may be required to comply with Section 409A of the Code and the regulations or other guidance issued thereunder, in the event of any merger, consolidation or share exchange pursuant to which the Company is not the surviving or resulting corporation, there shall be substituted for each share of Common Stock subject to the unexercised portions of outstanding Incentives, that number of shares of each class of stock or other securities or that amount of cash, property, or assets of the surviving, resulting or consolidated company which were distributed or distributable to the stockholders of the Company in respect to each share of Common Stock held by them, such outstanding Incentives to be thereafter exercisable for such stock, securities, cash, or property in accordance with their terms. 12.4 Cancellation of Incentives. Notwithstanding the provisions of Sections 12.2 and 12.3 hereof, and except as may be required to comply with Section 409A of the Code and the regulations or other guidance issued thereunder, all Incentives granted hereunder may be canceled by the Company, in its sole discretion, as of the effective date of any Change in Control, merger, consolidation or share exchange, or any issuance of bonds, debentures, preferred or preference stocks ranking prior to or otherwise affecting the Common Stock or the rights thereof (or any rights, options, or warrants to purchase same), or of any proposed sale of all or substantially all of the assets of the Company, or of any dissolution or liquidation of the Company, by either: VAALCO Energy, Inc. An Award that by its terms would be fully vested or exercisable upon a Change in Control will be considered vested or exercisable for purposes of Section 12.4(a) hereof. Article 13. Liquidation Or Dissolution Subject to Section 12.4 hereof, in case the Company shall, at any time while any Incentive under this Plan shall be in force and remain unexpired, (a) sell all or substantially all of its property, or (b) dissolve, liquidate, or wind up its affairs, then each Participant shall be entitled to receive, in lieu of each share of Common Stock of the Company which such Participant would have been entitled to receive under the Incentive, the same kind and amount of any securities or assets as may be issuable, distributable, or payable upon any such sale, dissolution, liquidation, or winding up with respect to each share of Common Stock of the Company. If the Company shall, at any time prior to the expiration of any Incentive, make any partial distribution of its assets, in the nature of a partial liquidation, whether payable in cash or in kind (but excluding the distribution of a cash dividend payable out of earned surplus and designated as such) and an adjustment is determined by the Committee to be appropriate to prevent the dilution of the benefits or potential benefits intended to be made available under the Plan, then the Committee shall, in such manner as it may deem equitable, make such adjustment in accordance with the provisions of Article 11 hereof. Article 14. Incentives in Substitution for Incentives Granted by Other Entities Incentives may be granted under the Plan from time to time in substitution for similar instruments held by employees, independent contractors or directors of a corporation, partnership, or limited liability company who become or are about to become Employees, Contractors or Outside Directors of the Company or any Subsidiary as a result of a merger or consolidation of the employing corporation with the Company, the acquisition by the Company of equity of the employing entity, or any other similar transaction pursuant to which the Company becomes the successor employer. The terms and conditions of the substitute Incentives so granted may vary from the terms and conditions set forth in this Plan to such extent as the Committee at the time of grant may deem appropriate to conform, in whole or in part, to the provisions of the incentives in substitution for which they are granted. 106 2024 Proxy Statement Article 15. Miscellaneous Provisions 15.1 Investment Intent. The Company may require that there be presented to and filed with it by any Participant under the Plan, such evidence as it may deem necessary to establish that the Incentives granted or the shares of Common Stock to be purchased or transferred are being acquired for investment and not with a view to their distribution. 15.2 No Right to Continued Employment. Neither the Plan nor any Incentive granted under the Plan shall confer upon any Participant any right with respect to continuance of employment by the Company or any Subsidiary. 15.3 Indemnification of Board and Committee. No member of the Board or the Committee, nor any officer or Employee of the Company acting on behalf of the Board or the Committee, shall be personally liable for any action, determination, or interpretation taken or made in good faith with respect to the Plan, and all members of the Board and the Committee, each officer of the Company, and each Employee of the Company acting on behalf of the Board or the Committee shall, to the extent permitted by law, be fully indemnified and protected by the Company in respect of any such action, determination, or interpretation to the fullest extent provided by law. Except to the extent required by any unwaiveable requirement under applicable law, no member of the Board or the Committee (and no Subsidiary of the Company) shall have any duties or liabilities, including without limitation any fiduciary duties, to any Participant (or any Person claiming by and through any Participant) as a result of this Plan, any Award Agreement or any Claim arising hereunder and, to the fullest extent permitted under applicable law, each Participant (as consideration for receiving and accepting an Award Agreement) irrevocably waives and releases any right or opportunity such Participant might have to assert (or participate or cooperate in) any Claim against any member of the Board or the Committee and any Subsidiary of the Company arising out of this Plan. 15.4 Effect of the Plan. Neither the adoption of this Plan nor any action of the Board or the Committee shall be deemed to give any person any right to be granted an Award or any other rights except as may be evidenced by an Award Agreement, or any amendment thereto, duly authorized by the Committee and executed on behalf of the Company, and then only to the extent and upon the terms and conditions expressly set forth therein. 15.5 Compliance with Other Laws and Regulations. Notwithstanding anything contained herein to the contrary, the Company shall not be required to sell or issue shares of Common Stock under any Incentive if the issuance thereof would constitute a violation by the Participant or the Company of any provisions of any law or regulation of any governmental authority or any national securities exchange or inter-dealer quotation system or other forum in which shares of Common Stock are quoted or traded (including without limitation Section 16 of the Exchange Act); and, as a condition of any sale or issuance of shares of Common Stock under an Incentive, the Committee may require such agreements or undertakings, if any, as the Committee may deem necessary or advisable to assure compliance with any such law or regulation. The Plan, the grant and exercise of Incentives hereunder, and the obligation of the Company to sell and deliver shares of Common Stock, shall be subject to all applicable federal and state laws, rules and regulations and to such approvals by any government or regulatory agency as may be required. 15.6 Foreign Participation. To assure the viability of Awards granted to Participants employed in foreign countries, the Committee may provide for such special terms as it may consider necessary or appropriate to accommodate differences in local law, tax policy or custom. Moreover, the Committee may approve such supplements to, or amendments, restatements or alternative versions of, this Plan as it determines is necessary or appropriate for such purposes. Any such amendment, restatement or alternative versions that the Committee approves for purposes of using this Plan in a foreign country will not affect the terms of this Plan for any other country. 15.7 Tax Requirements. The Company or, if applicable, any Subsidiary (for purposes of this Section 15.7, the term “Company” shall be deemed to include any applicable Subsidiary), shall have the right to deduct from all amounts paid in cash or other form in connection with the Plan, any federal, state, local, or other taxes required by law to be withheld in connection with an Award granted under this Plan. The Company may, in its sole discretion, also require the Participant receiving shares of Common Stock issued under the Plan to pay the Company the amount of any taxes that the Company is required to withhold in connection with the Participant’s income arising with respect to the Award. Such payments shall be required to be made when requested by the Company and may be required to be made prior to the delivery of any certificate representing shares of Common Stock. Such payment may be made by (a) the delivery of cash to the Company in an amount that equals or exceeds (to avoid the issuance of fractional shares under (c) below) the required tax withholding obligations of the Company; (b) if the Company, in its sole discretion, so consents in writing, the actual delivery by the exercising Participant to the Company of shares of Common Stock that the Participant has not acquired from the Company within six (6) months prior to the date of exercise, which shares so delivered have an aggregate Fair Market Value that equals or exceeds (to avoid the issuance of fractional shares under (c) below) the required tax withholding payment; (c) if the Company, in its sole discretion, so consents in writing, the Company’s withholding of a number of shares to be delivered upon the exercise of the Stock Option, which shares so withheld have an aggregate fair market value that equals (but does not exceed) the required tax withholding payment; or (d) any combination of (a), (b), or (c). The Company may, in its sole discretion, withhold any such taxes from any other cash remuneration otherwise paid by the Company to the Participant. The Committee may in the Award Agreement impose any additional tax requirements or provisions that the Committee deems necessary or desirable. 107 VAALCO Energy, Inc. 15.8 Assignability. Incentive Stock Options may not be transferred, assigned, pledged, hypothecated or otherwise conveyed or encumbered other than by will or the laws of descent and distribution and may be exercised during the lifetime of the Participant only by the Participant or the Participant’s legally authorized representative, and each Award Agreement in respect of an Incentive Stock Option shall so provide. The designation by a Participant of a beneficiary will not constitute a transfer of the Stock Option. The Committee may waive or modify any limitation contained in the preceding sentences of this Section 15.8 that is not required for compliance with Section 422 of the Code. Except as otherwise provided herein, Awards may not be transferred, assigned, pledged, hypothecated or otherwise conveyed or encumbered other than by will or the laws of descent and distribution. Notwithstanding the foregoing, the Committee may, in its discretion, authorize all or a portion of a Nonqualified Stock Option or SAR to be granted to a Participant on terms which permit transfer by such Participant to (a) the spouse (or former spouse), children or grandchildren of the Participant (“Immediate Family Members”), (b) a trust or trusts for the exclusive benefit of such Immediate Family Members, (c) a partnership in which the only partners are (1) such Immediate Family Members and/or (2) entities which are controlled by the Participant and/or Immediate Family Members, (d) an entity exempt from federal income tax pursuant to Section 501(c)(3) of the Code or any successor provision, or (e) a split interest trust or pooled income fund described in Section 2522(c)(2) of the Code or any successor provision, provided that (x) there shall be no consideration for any such transfer, (y) the Award Agreement pursuant to which such Nonqualified Stock Option or SAR is granted must be approved by the Committee and must expressly provide for transferability in a manner consistent with this Section, and (z) subsequent transfers of transferred Nonqualified Stock Options or SARs shall be prohibited except those by will or the laws of descent and distribution. Following any transfer, any such Nonqualified Stock Option and SAR shall continue to be subject to the same terms and conditions as were applicable immediately prior to transfer, provided that for purposes of Articles 8, 9, 11, 13 and 15 hereof the term “Participant” shall be deemed to include the transferee. The events of Termination of Service shall continue to be applied with respect to the original Participant, following which the Nonqualified Stock Options and SARs shall be exercisable or convertible by the transferee only to the extent and for the periods specified in the Award Agreement. The Committee and the Company shall have no obligation to inform any transferee of a Nonqualified Stock Option or SAR of any expiration, termination, lapse or acceleration of such Stock Option or SAR. The Company shall have no obligation to register with any federal or state securities commission or agency any Common Stock issuable or issued under a Nonqualified Stock Option or SAR that has been transferred by a Participant under this Section 15.8. 108 2024 Proxy Statement 15.9 Use of Proceeds. Proceeds from the sale of shares of Common Stock pursuant to Incentives granted under this Plan shall constitute general funds of the Company. 15.10 Legend. Each certificate representing shares of Restricted Stock issued to a Participant shall bear the following legend, or a similar legend deemed by the Company to constitute an appropriate notice of the provisions hereof (any such certificate not having such legend shall be surrendered upon demand by the Company and so endorsed): On the face of the certificate: “TRANSFER OF THIS STOCK IS RESTRICTED IN ACCORDANCE WITH CONDITIONS PRINTED ON THE REVERSE OF THIS CERTIFICATE.” On the reverse: “THE SHARES OF STOCK EVIDENCED BY THIS CERTIFICATE ARE SUBJECT TO AND TRANSFERABLE ONLY IN ACCORDANCE WITH THAT CERTAIN VAALCO ENERGY, INC. 2020 LONG TERM INCENTIVE PLAN, AND THAT CERTAIN AWARD AGREEMENT ENTERED INTO BY AND BETWEEN THE COMPANY AND THE PARTICIPANT, COPIES OF WHICH ARE ON FILE AT THE PRINCIPAL OFFICE OF THE COMPANY IN HOUSTON, TEXAS NO TRANSFER OR PLEDGE OF THE SHARES EVIDENCED HEREBY MAY BE MADE EXCEPT IN ACCORDANCE WITH AND SUBJECT TO THE PROVISIONS OF SAID PLAN. BY ACCEPTANCE OF THIS CERTIFICATE, ANY HOLDER, TRANSFEREE OR PLEDGEE HEREOF AGREES TO BE BOUND BY ALL OF THE PROVISIONS OF SAID PLAN.” The following legend shall be inserted on a certificate evidencing Common Stock issued under the Plan if the shares were not issued in a transaction registered under the applicable federal and state securities laws: “SHARES OF STOCK REPRESENTED BY THIS CERTIFICATE HAVE BEEN ACQUIRED BY THE HOLDER FOR INVESTMENT AND NOT FOR RESALE, TRANSFER OR DISTRIBUTION, HAVE BEEN ISSUED PURSUANT TO EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF APPLICABLE STATE AND FEDERAL SECURITIES LAWS, AND MAY NOT BE OFFERED FOR SALE, SOLD OR TRANSFERRED OTHER THAN PURSUANT TO EFFECTIVE REGISTRATION UNDER SUCH LAWS, OR IN TRANSACTIONS OTHERWISE IN COMPLIANCE WITH SUCH LAWS, AND UPON EVIDENCE SATISFACTORY TO THE COMPANY OF COMPLIANCE WITH SUCH LAWS, AS TO WHICH THE COMPANY MAY RELY UPON AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY.” 15.11 Governing Law. The Plan shall be governed by, construed, and enforced in accordance with the laws of the State of Delaware (excluding any conflict of laws, rule or principle of Delaware law that might refer the governance, construction, or interpretation of this Plan to the laws of another state). A Participant’s sole remedy for any Claim shall be against the Company, and no Participant shall have any claim or right of any nature against any Subsidiary of the Company or any stockholder or existing or former director, officer or Employee of the Company or any Subsidiary of the Company. The individuals and entities described above in this Section 15.11 (other than the Company) shall be third-party beneficiaries of this Plan for purposes of enforcing the terms of this Section 15.11. A copy of this Plan shall be kept on file in the principal office of the Company in Houston, Texas. IN WITNESS WHEREOF, the Company has caused this instrument to be executed as of April 27, 2020, by its Chief Executive Officer pursuant to prior action taken by the Board. By:/s/ Cary Bounds Cary M. Bounds Chief Executive Officer 109 VAALCO Energy, Inc. Appendix A-2 First Amendment to Vaalco Energy, Inc. 2020 Long Term Incentive Plan This FIRST AMENDMENT TO THE VAALCO ENERGY, INC. 2020 LONG TERM INCENTIVE PLAN (this “Amendment”), effective as of June 3, 2021, is made and entered into by VAALCO Energy, Inc., a Delaware corporation (the “Company”). Terms used in this Amendment with initial capital letters that are not otherwise defined herein shall have the meanings ascribed to such terms in the VAALCO Energy, Inc. 2020 Long Term Incentive Plan, effective as of April 27, 2020 (the “2020 Plan”). Recitals WHEREAS, pursuant to Article 9 of the 2020 Plan, the Board may, at any time and from time to time, amend the 2020 Plan, provided that, under certain circumstances, such amendment shall be approved by the requisite vote of the stockholders of the Company entitled to vote thereon; WHEREAS, the Company desires to amend the 2020 Plan to increase the maximum number of shares of Common Stock that may be delivered pursuant to Awards granted under the 2020 Plan from 5,500,000 shares to 9,250,000 shares of Common Stock; WHEREAS, the Board approved this Amendment on March 3, 2021, subject to approval by the Company’s stockholders; and WHEREAS, this Amendment was submitted to the stockholders of the Company for their approval and was approved on June 3, 2021. NOW, THEREFORE, in accordance with Article 9 of the 2020 Plan, the Company hereby amends the 2020 Plan as follows: 5.1 Number Available for Awards. Subject to adjustment as provided in Articles 11 and 12, the maximum number of shares of Common Stock that may be delivered pursuant to Awards granted under the Plan is nine million two hundred fifty thousand (9,250,000) shares plus any Prior Plan Awards, of which up to one million (1,000,000) shares may be delivered pursuant to Incentive Stock Options. Shares to be issued may be made available from authorized but unissued Common Stock, Common Stock held by the Company in its treasury, or Common Stock purchased by the Company on the open market or otherwise. During the term of this Plan, the Company will at all times reserve and keep available the number of shares of Common Stock that shall be sufficient to satisfy the requirements of this Plan. 110 2024 Proxy Statement APPENDIX B NON-GAAP Financial Measures Adjusted EBITDAX is a supplemental non-GAAP financial measure used by VAALCO’s management and by external users of the Company’s financial statements, such as industry analysts, lenders, rating agencies, investors and others who follow the industry as an indicator of the Company’s ability to internally fund exploration and development activities and to service or incur additional debt. Adjusted EBITDAX is a non-GAAP financial measure and as used herein represents net income before discontinued operations, interest income (expense) net, income tax expense, depletion, depreciation and amortization, impairment of proved properties, exploration expense, non-cash and other items including stock compensation expense and commodity derivative loss. Management uses Free Cash Flow to evaluate financial performance and to determine the total amount of cash over a specified period available to be used in connection with returning cash to shareholders, and believes the measure is useful to investors because it provides the total amount of net cash available for returning cash to shareholders by adding cash generated from operating activities, subtracting amounts used in financing and investing activities, and adding back amounts used for dividend payments and stock repurchases. Free Cash Flow is a non-GAAP financial measure and as used herein represents net change in cash, cash equivalents and restricted cash and adds the amounts paid under dividend distributions and share repurchases over a specified period. The non-GAAP measure utilized herein have significant limitations, including that they may not reflect the Company’s cash requirements for capital expenditures, contractual commitments, working capital or debt service. Non-GAAP financial measures should not be considered as a substitute for their corresponding nearest applicable GAAP measure or for net income (loss), operating income (loss), cash flows from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Non-GAAP measures may exclude some, but not all, items that affect net income (loss) and operating income (loss) and these measures may vary among other companies. Therefore, the Company’s non-GAAP measures may not be comparable to similarly titled measures used by other companies. The tables below reconcile the most directly comparable GAAP financial measures to Adjusted EBITDAX and Free Cash Flow. 111 VAALCO Energy, Inc. Reconciliations of Non-GAAP Financial Measures (in thousands) 112 2024 Proxy Statement 113 Washington,Proxy Statement Pursuant to Section 14(a) ofSecurities Exchange Act of 1934(Amendment No. )Filed by the Registrant ☒Filed by a Party other than the Registrant ☐☐ Statement.Statement Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) . ☒Definitive Proxy Statement.☐ § 240.14a-12.§240.14a-12 VAALCO ENERGY, INC.(Name of Registrant as Specified In Its Charter)(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)the appropriate box)all boxes that apply):☒ ☐ belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.